Bank of England policymakers are expected to keep interest rates at 4.5 per cent this Thursday (March 20) amid growing economic uncertainty.

The Monetary Policy Committee (MPC) has been gradually reducing borrowing costs since August last year, providing some relief to mortgage holders.

However, the central bank’s governor Andrew Bailey has emphasised the need for a “gradual and careful approach” to rate cuts.

The decision comes as officials navigate concerns about US President Donald Trump’s developing tariff policies and forthcoming UK tax increases.

The Bank of England is forecast to keep interest rates at 4.5%

GETTY

Sandra Horsfield, an analyst for Investec Economics, described this uncertainty as “an unavoidable constant in economic forecasting.”

Policymakers must consider the inflation impact of potential spending cuts in the Government’s spring statement due later this month.

The consumer price index (CPI) has eased from its Covid ear heights of 11.1 per cent in recent months, but remains higher than the Bank’s desired two per cent rate.

Furthermore, the committee will also be assessing the effects of new US tariffs on UK steel and aluminium, which were announced by President Trump last week.

The Bank of England previously noted that additional costs for businesses from April’s changes could either increase unemployment or drive inflation if retailers pass costs to customers.

UK inflation has risen in recent months, reaching three per cent in January, according to official data. This increase has been primarily driven by energy prices, water bills and bus fares.

Horsfield described the latest figures as “bittersweet” as while the inflation rise “will not have been welcomed”, there was some positive news.

The 0.2 percentage point “downside surprise” in services inflation offered relief to policymakers. Services inflation has been particularly concerning for the MPC, even as overall inflation has fallen.

Trump’s plan of new tariffs have sent shockwaves through the stock marketsGETTY

Trump’s plan of new tariffs have sent shockwaves through the stock marketsGETTY The Bank’s response to these developments will be crucial for economic stability.

Global economic uncertainty is being further fuelled by the Trump administration’s tariff agenda, which has seen the stock market plummet.

Robert Wood and Elliott Jordan-Doak, economists at Pantheon Macroeconomics, said the MPC will “have to consider US President Trump’s actions”.

Tariffs have been “driving an equity market sell-off and skyrocketing uncertainty”, which is raising concerns about the outlook for global economic growth.

However, the economists added that the Bank’s committee is “as unable as anyone else to predict Mr Trump’s next move”.

LATEST DEVELOPMENTS:

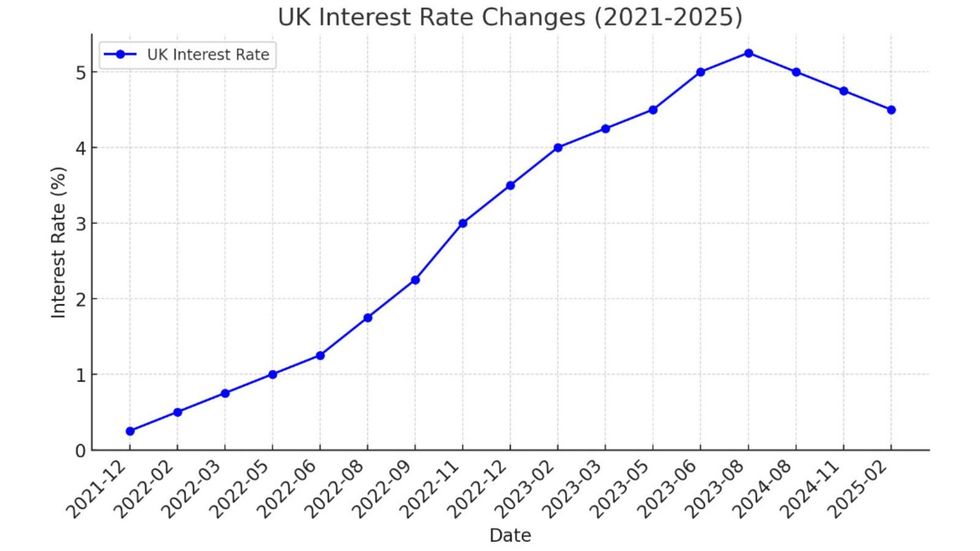

The Bank of England has made multiple changes to the base rate in recent years CHAT GPT

The Bank of England has made multiple changes to the base rate in recent years CHAT GPT Despite the current uncertainty, economists remain cautiously optimistic about future rate cuts.

This is despite Pantheon Macroeconomics economists predicting the base rate will hold in the coming days.

They forecast two more cuts will come in May and November this year.

Andrew Goodwin from Oxford Economics similarly expects the MPC to maintain the 4.5 per cent rate this week amid the heightened uncertainty.