Drivers of diesel vehicles could face huge car tax increases next month of up to £15,000, with many motorists left paying more than triple.

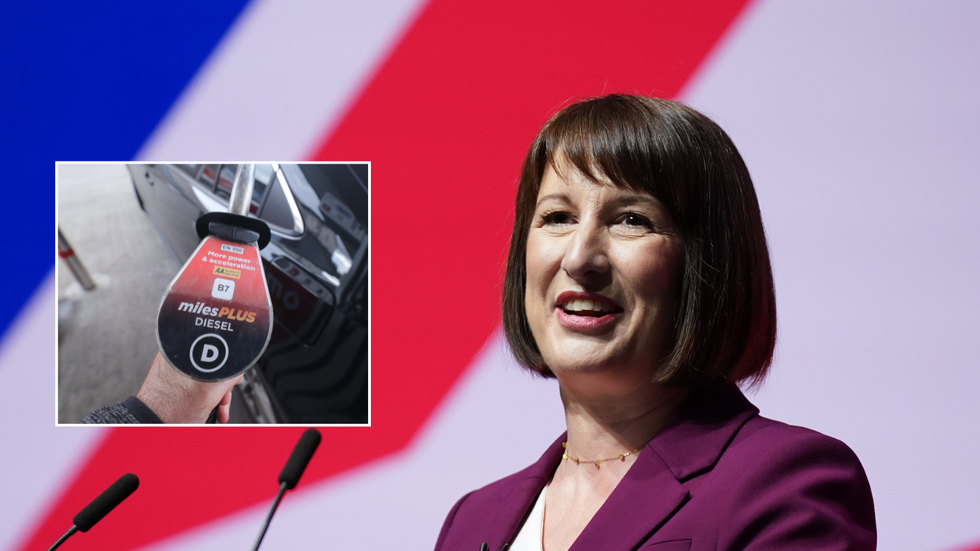

The car tax increases come after Chancellor Rachel Reeves announced changes to the Benefit-in-Kind rates in October last year, which has subsequently led to drivers paying more.

The changes would impact double cab pick-up trucks, which will soon be reclassified as cars for the first time following the Autumn Statement announcement by Reeves.

From April 2025, double cab pick-ups will face new emissions-based charges, hitting high-emission diesel models hardest.

Do you have a story you’d like to share? Get in touch by emailing[email protected]

Diesel vehicles will be hit with the highest BiK rates under new rules coming in April

PA

Experts have warned businesses and tradespeople who relyon these vehiclesto reconsider their fleets, with many expected to switch to vans or electric alternatives as a result of the tax changes.

With key deadlines looming, experts have advised reviewing tax positions before the changes take effect. Currently, light commercial vehicles such as double cab pick-ups with a carrying capacity of one tonne or more face a flat BiK tax rate of £3,960 annually for company drivers.

However, from April, due to the reclassification, the BiK rate will be calculated on a sliding scale based on emissions with some charges going up as much as £15,000 per year, experts from Bumper noted.

Given the typically high-emission diesel engines of most double-cab pickups, this change is expected to substantially increase drivers’ tax bills.

A motoring expert from Bumper said: “The new regulations may lead businesses in industries like construction and farming to rethink their pickup vehicle fleets. While reliable, double cab pick-ups will face higher BiK taxes, which will lead to increased costs for employers due to added National Insurance contributions.

“Many businesses might switch to traditional vans to reduce the tax burden, which still benefits from lower BiK rates. We might also see a switch to electric vehicles which offer reduced taxes thanks to their lower emissions.”

But according to HMRC, any business that purchased, ordered, or leased a double cab pick-up before April 2025 can continue using previous tax treatments.

This transactional treatment will only be valid until the vehicle is disposed of, or the lease expires before April 5, 2029.

“So, if you currently have one of these pickups, you have some flexibility before and after the new tax rules are implemented,” the spokesperson noted.

Additionally, from April 6, for income tax, double cab pick-ups will be classified as cars for BiK and profit deductions.

The Association of Chartered Certified Accountants shared: “HMRC will no longer align its interpretation of the terms ‘car’ and ‘van’ for tax purposes with the definitions used for VAT purposes.

“Classification of double cab pickups will therefore need to be determined by assessing the vehicle as a whole at the point that it is made available to determine whether the vehicle construction has a primary suitability as per the two-part test outlined at EIM23115 onwards.”

LATEST DEVELOPMENTS:

- Elderly driver banned for life after hitting three-year old with car – ‘Simply should not be on the road’

- Major car brand could axe iconic estate family cars after more than 70 years despite U-turn last year

- Toyota ramps up electric car offering to avoid £15k fines for having more petrol vehicles on sale

Car tax hikes will come into effect in April 2025PA

Car tax hikes will come into effect in April 2025PAUnder the new changes, petrol and diesel company cars will continue to attract higher BiK rates of between 25 and 37 per cent.

According to Fleet Management, BiK taxes are based on certain factors:

- The car’s P11D value – This is the list price, including VAT and optional extras, but excluding registration fees and road tax

- CO2 emissions – The Government sets BiK rates based on how polluting a car is

- BIK percentage rate – This is linked to emissions and fuel type (EVs get the lowest rate)

- Income tax band – Whether you pay 20 per cent, 40 per cent, or 45 per cent tax affects the total owed