UK banks are borrowing the most since the Covid-19 pandemic from the Bank of England’s Indexed Long-Term Repo facility following recent interest rate cuts.

Outstanding usage has exceeded £10billion for the first time since 2020. This milestone follows Tuesday’s operation where banks borrowed £1.33billion, the largest single operation since April 2020.

The facility provides banks with cash in exchange for collateral pledged over a six-month period. A separate one-week repo facility also hit a fresh record last week.

These developments come as the central bank attempts to remove excess liquidity from the financial system that accumulated during years of quantitative easing

Part of the Bank of England’s strategy involves transitioning from gilt-based liquidity to repo-based provision of cash. This shift aims to wean markets off the abundant liquidity fuelled by years of gilt purchases.

Do you have a money story you’d like to share? Get in touch by emailing [email protected].

Instead, the central bank wants to provide cash via repurchase operations where banks pledge collateral. However, this transition raises the risk of market volatility.

Officials are closely monitoring sterling money markets for any signs of tension. The central bank is simultaneously reversing years of bond purchases.

It is also winding down pandemic-era programmes that offered cheap loans to banks.

Britain’s approach of actively selling gilts from its portfolio is notably more aggressive than most other central banks.

“Money market rates are clearly shifting to levels which suggest that a simple shift from a gilt-based to a repo-based portfolio may not be that easy to implement,” said Pooja Kumra, senior UK and European rates strategist at Toronto-Dominion Bank.

Kumra noted that the smoothness is “dependent on how easily the banks can adapt to the lack of the BOE’s footprint in the gilt market”.

This adaptation challenge comes as banks must adjust to reduced central bank presence in government bond markets.

Furthermore, the Bank of England is actively encouraging financial institutions to utilise its facilities.

A spokesman told Bloomberg News on Tuesday: “We’re open for business and welcome continued use of the ILTR. We expect and encourage firms to use our facilities much more.”

Central bank officials have consulted market participants on improving repo operations.

LATEST DEVELOPMENTS:

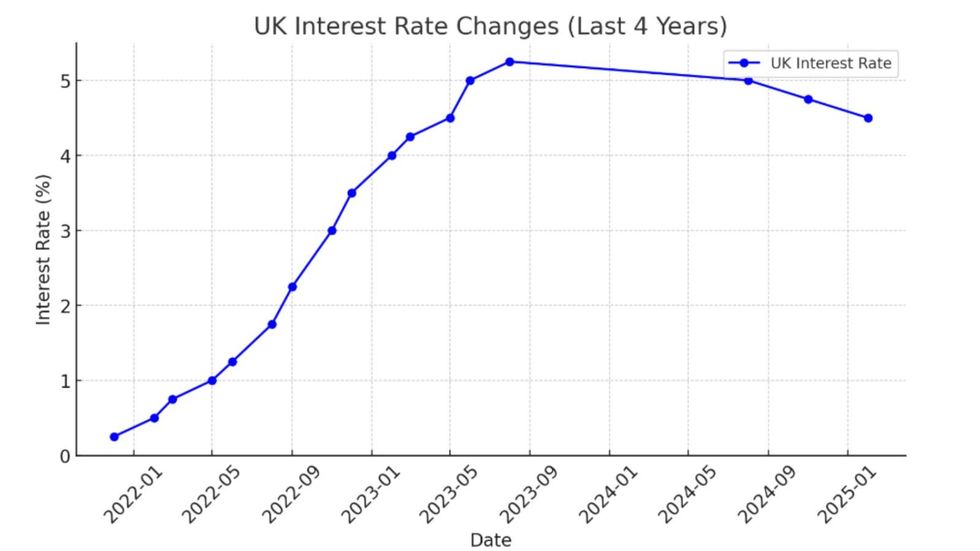

Interest rates have skyrocketed in recent years due to the Bank of England’s decison-making CHATGPT

Interest rates have skyrocketed in recent years due to the Bank of England’s decison-making CHATGPTBoth the International Capital Market Association and UK Finance are advocating for additional tenors and a move to a triparty repo system.

This would outsource post-trade processing to third-party agents, reducing operational friction.

ICMA stated earlier this year that the current system “is a deterrent” and “could be more so in stressed market conditions. The process for confirming collateral eligibility should be significantly expedited and automated.”

While other central banks are also tightening monetary conditions, Britain’s active gilt sales represent a more decisive stance.