Chancellor Rachel Reeves has been dealt another blow to her fiscal agenda as the Bank of England has downgraded its growth forecast for the UK economy to 0.75 per cent.

The central bank confirmed it has revised its prediction down from previous estimates of 1.5 per cent, before projecting that economic growth will accelerate again in 2026 and 2027.

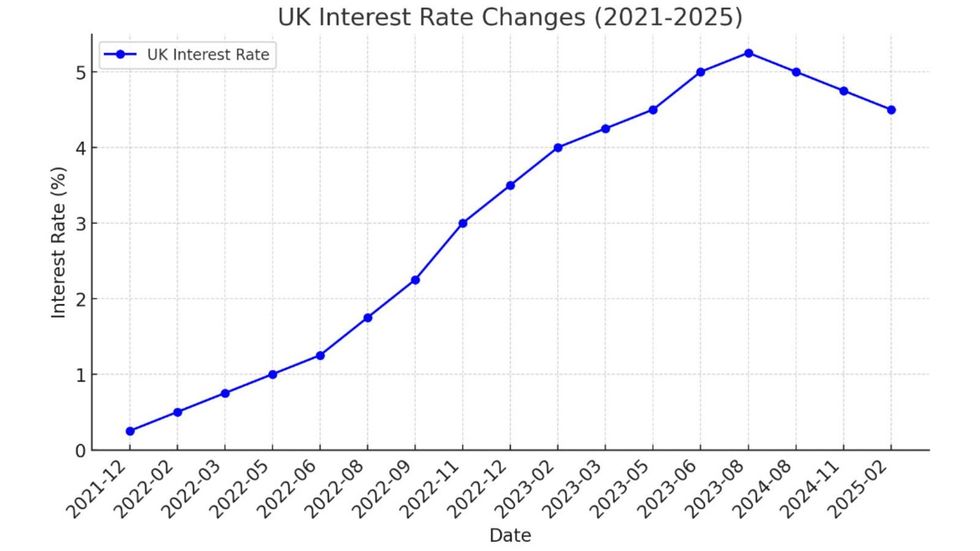

Earlier this morning, the Bank’s Monetary Policy Committee (MPC) announced the base rate will be slashed from 4.75 per cent to 4.5 per cent in a win for mortgage holders and debt borrowers.

However, the Bank of England’s downgrade is a roadblock for Reeves’s plans to “kickstart the economy” with the Chancellor recently unveiling plans for a third runway in Heathrow and the Oxford-Cambridge Growth Corridor.

Despite referring to the interest rate cut as “welcome news”, she said: “I am still not satisfied with the growth rate. Our promise in our Plan for Change is to go further and faster to kick-start economic growth to put more money in working people’s pockets.”

Do you have a money story you’d like to share? Get in touch by emailing [email protected].

The Chancellor has been dealt another blow to her fiscal agenda as economy growth forecasts have been downgraded

GETTY

The latest revision from the Bank of England comes amid signs inflation is rising again, with estimates signaling to a higher-than-expected peak of 3.7 per cent later in the summer.

Victor Trokoudes, the founder and CEO of smart money app Plum, previously cited forecasts of further interest rate cuts from the Bank in 2025 but warned a stagnant economy could put call these projections into question.

He explained: “These different interpretations reflect diverging views over future UK economic performance. Some analysts are pessimistic, predicting that continued growth stagnation will necessitate further cuts to help stimulate the economy.

“The recent fall in inflation, in particular services inflation, outlined in December’s reading, opened up this opportunity for the MPC to cut the base rate to boost growth. In turn, they’ll be hoping that inflation continues to stabilise around the two per cent target.”

The Bank of England has made multiple changes to the base rate over the years

CHAT GPT

THIS IS A BREAKING NEWS STORY…MORE TO FOLLOW

LATEST DEVELOPMENTS: