A new petition calling for a ban on higher car insurance premiums for drivers over 70 has been launched with campaigners urging the Government to respond.

The petition, which has already gathered nearly 1,000 signatures, aims to address what campaigners say is age discrimination by insurers.

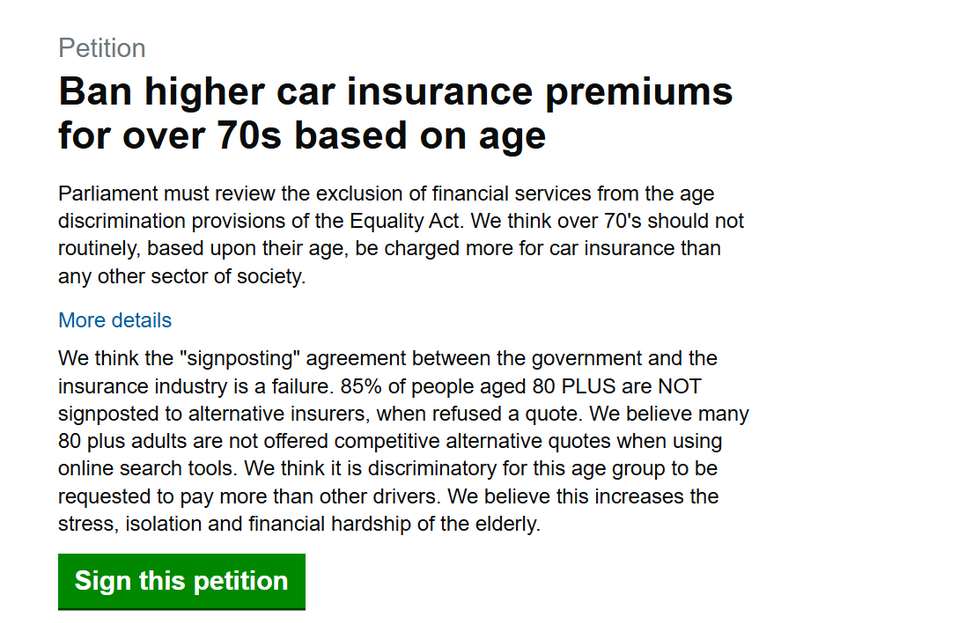

The initiative seeks to challenge the current exclusion of financial services from age discrimination provisions in the Equality Act.

If successful, the petition could prevent insurance companies from routinely charging higher premiums to drivers based solely on their age being over 70.

Do you have a story you’d like to share? Get in touch by emailing[email protected]

If the petition received 10,000 signatures Labour will have to respond

GETTY

The petition launched by Sarah Kelly specifically challenges the “signposting” agreement between the Government and insurance industry, which it claims has failed to protect elderly drivers.

It detailed: “We think the ‘signposting’ agreement between the government and the insurance industry is a failure.

“85 per cent of people aged 80 PLUS are NOT signposted to alternative insurers, when refused a quote. We believe many 80 plus adults are not offered competitive alternative quotes when using online search tools.

“We think it is discriminatory for this age group to be requested to pay more than other drivers. We believe this increases the stress, isolation and financial hardship of the elderly.”

The petition states that older drivers should not be charged more for car insurance than other sectors of society purely based on their age.

This move comes as concerns grow about fair access to insurance services for elderly motorists.

The campaign highlights particular concerns about online search tools, suggesting elderly drivers are not being offered competitive alternative quotes through these platforms.

This failure in the signposting system appears to be leaving older motorists with limited options when seeking insurance coverage.

The issue is especially pressing as recent figures have shown car insurance costs have risen significantly, with the petition suggesting elderly drivers are being disproportionately affected.

The current system’s ineffectiveness means many older drivers may be paying unnecessarily high premiums or struggling to find appropriate coverage for their vehicles.

The petition has until May 20, 2025 to reach its signature targets. If the campaign reaches 10,000 signatures, the Government will be required to provide an official response. But if the petition gathers 100,000 signatures, it will be considered for debate in Parliament.

Car insurance typically becomes cheaper as drivers age and gain experience, but this trend seems to reverse for drivers in their 70s and 80s.

LATEST DEVELOPMENTS:

The petition has already gained nearly 1,000 signatures

PETITIONS.PARLIAMENT

Insurance providers consider statistical risk factors when calculating premiums, which can lead to higher costs for elderly drivers.

However, Money Saving Expert notes that older people typically demonstrate safer driving habits, including driving shorter distances and at safer times of day.

Some insurers set their own age limits for coverage, though there is no legal maximum age for car insurance. For drivers over 70, licence renewal is required every three years, though this doesn’t require retaking the driving test.