Keir Starmer has been branded a “coward” by a furious farmer after the Prime Minister did not face up to protesters in Wales yesterday.

Farmers had gathered outside the Welsh Labour conference to voice their dismay at the changes to inheritance tax unveiled in Rachel Reeves’ first Budget.

They gathered with tractors outside the conference venue in Llandudno and were left disappointed by Starmer’s decision not to meet them.

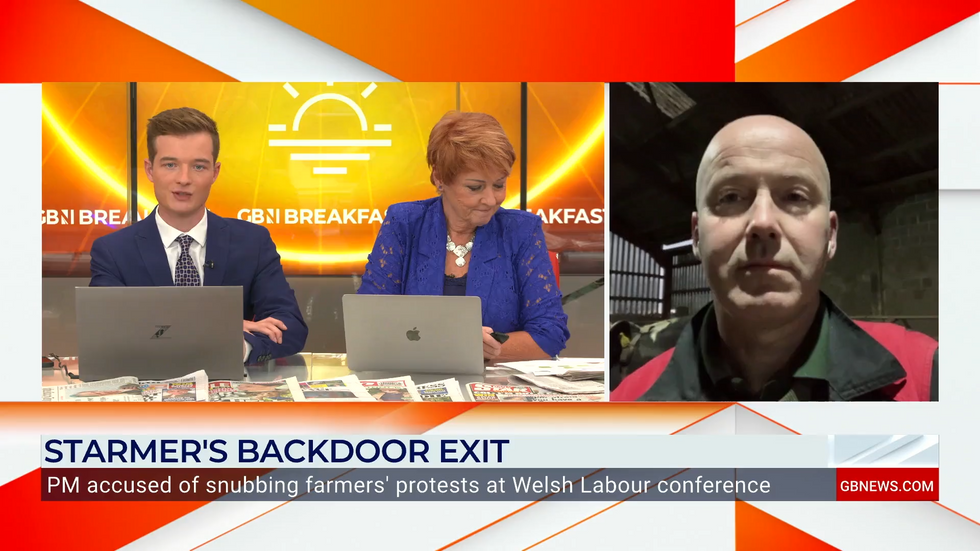

Speaking to GB News, Charles Goadby said there has been a lack of support from the Government.

PA / GB NEWS

“I wasn’t surprised in the slightest”, he told Cameron Walker and Anne Diamond.

“I think all the way through this, we’ve just seen cowardly acts by everyone in Government.

LATEST DEVELOPMENTS

Farmers protest in WalesGETTY

Farmers protest in WalesGETTY“They have realised their figures are wrong, we’ve got the evidence to show that they’re wrong, but they’re just burying their head in the sand and don’t want to admit it.”

Starmer has insisted he will continue to defend the Budget’s cost-cutting measures, saying they are necessary to plug a ‘black hole’ in public finance.

But Goadby thinks Labour has got it wrong with their estimates when planning the inheritance tax changes.

“They’ve based their figures purely on agricultural relief in the year 2021 to 2022”, he said.

Charles Goadby joined Cameron Walker and Anne Diamond on GB News

GB NEWS

“In that year, there were 1,730 claims for inheritance tax relief, agricultural relief and based on those figures alone, yes, 73 per cent of farmers would not be affected.

“But what the Government has failed to tell us and what has come out in a written Parliamentary question at the Treasury Select Committee is that, of those 1,730 claims, 45 per cent of them also claimed for business relief as well.

“That doesn’t include those that claim for business relief without agricultural relief.

“So actually, the Government are basing this policy on figures that don’t add up.”

The changes will see new taxes for farms worth more than £1 million – and many have questioned the figures Reeves based the decision on.

Treasury data suggests around three-quarters of farmers will pay nothing in inheritance tax as a result of the controversial changes announced in the Budget last month.

Farmers have challenged the figures, pointing to Department for Environment Food and Rural Affairs data which suggests 66 per cent of farm businesses are worth more than the £1 million threshold at which inheritance tax will now need to be paid.

Starmer did not mention the inheritance tax explicitly in his speech at the conference, but said he would defend the “tough decisions” his Government has made.

“Make no mistake, I will defend our decisions in the Budget all day long, adding: “I will defend facing up to the harsh light of fiscal reality.

“I will defend the tough decisions that would necessary to stabilise our economy and I will defend protecting the pay slips of working people, fixing the foundations of our economy and investing in the future of Britain and the future of Wales, finally turning the page on austerity once and for all.”