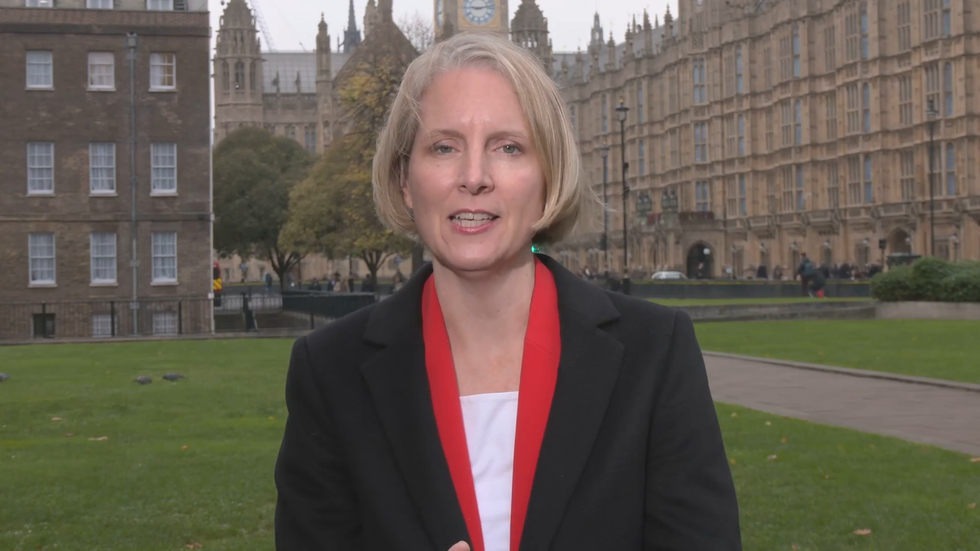

The UK Government plans to create pension megafunds that could unlock billions of pounds for infrastructure investment, Pensions Minister Emma Reynolds has told GB News.

The initiative aims to consolidate existing pension schemes into larger funds capable of making substantial investments in major projects across Britain.

The move follows successful models established in Australia and Canada, where large-scale pension funds have already demonstrated significant success in infrastructure investment.

Reynolds highlighted how the UK is lagging behind international counterparts in pension fund investments.

‘New pension megafunds plan will unlock billions for investment in infrastructure,’ says minister

GB News

“If we look at what’s happening in Australia and Canada, where they have the best pension funds in the world, we see that because they have these megafunds, these big pension funds who can invest at scale,” she told GB News.

“In fact, if you’re an Australian professor or a Canadian teacher, you’re more likely to be invested in UK infrastructure than UK pension savers.

LATEST DEVELOPMENTS

“As the Pensions Minister, let me be absolutely clear that it is these two objectives that I’m holding in my mind all the time, which is boosting investment in our own economy, but at the same time boosting pension savers at retirement incomes.”

She described it as a “win-win situation” where larger funds would have better in-house expertise to make investments across a broader range of assets.

The consolidation aims to deliver improved returns for pension savers while strengthening the UK economy.

The pension megafunds are used in Canada

Getty

To address practical implementation concerns, Reynolds pointed to the creation of the National Wealth Fund.

The Government is also implementing ambitious planning reforms and establishing Skills England to ensure a robust pipeline of projects.

She explained: “There’s the sort of demand side, which is making sure we get more pension investment into our own economy.

“If Canadian and Australian pension funds can find opportunities in the UK, it shouldn’t be beyond our pension funds to do the same.”