Rachel Reeves will announce her government-defining budget this afternoon in what has already been dubbed as the ‘biggest tax raid in history’.

Britain’s first female Chancellor wants to raise £35 billion by increasing borrowing, slashing spending and, controversially, raising taxes, a move that’s led Keir Starmer to warn the impending budget “will be painful.”

The money is needed to fix a “£22billion black hole” in the nations’ finances left over from the previous Conservative government, argues Reeves.

However, the Chancellor pledged not to raise taxes on working people, meaning changes to income tax, VAT and National Insurance- some of the treasuries’ biggest sources of income- are off the table.

The pledge has led to weeks of confused squabbling over what the definition of a ‘working person’ is with ministers’ answers changing almost daily. That, however, will finally end this afternoon when Reeves’ plans are laid bare, or at least the ones that haven’t been leaked yet.

Here are some of ways Reeves might try to squeeze more money out of you.

Inheritance Tax (IHT)

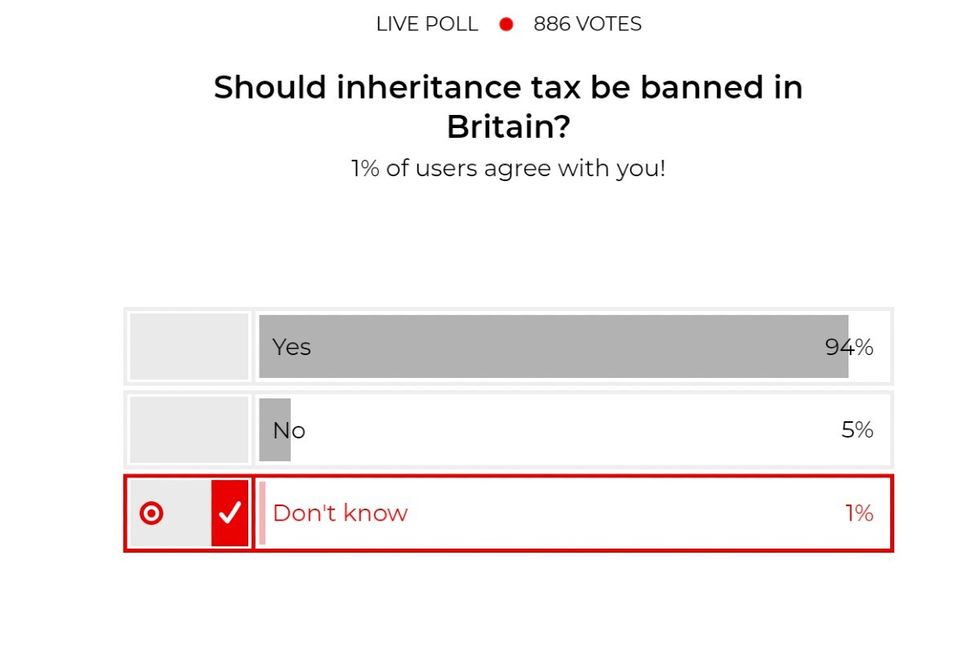

There has been heavy speculation over whether Labour will tinker with ‘Britain’s most hated tax’ which they’ll argue can redistribute generational wealth.

IHT is currently raking in record levels for the treasury at £2.2 billion per year, but Reeves may go further and up the threshold “death tax” kicks in at from 40 per cent on estates over £325,000 to 45 per cent.

The Labour Chancellor could also clamp down on loopholes in current legislation, such as the ability to pass on money tax free seven years before someone dies.

Pensions, which can be inherited tax free, could lose their exemption, as could farms if Reeves removes Agricultural Property Relief (APR), though many farmers have warned this would kickstart the death of family farm, widely perceived as the backbone of British agriculture.

A GB News poll about inheritance tax in May 2024

GB NEWS

Capital Gains Tax

This is a prime contender for Labour’s tax hikes and involves the Treasury siphoning off a percentage of sales of things like a second home, shares or other valuable assets.

The government could choose to lower the threshold of when Capital Gains Tax is due, which is currently £3000.

Or it could increase the percentage it takes of sales over that amount.

Sarah Coles, of Hargreaves Lansdown, said: “Labour hasn’t ruled out raising capital gains tax. It would enable the Government to deliver on the promise not to raise taxes for ‘working people’, because it’s a tax on wealth.

“However, it’s a tough balancing act, because it doesn’t sit well with its plans to be a government that helps people create wealth. If they were to make changes, they’d have a wide range of options.”

Fuel Duty

This motorist tax has been frozen since 2011-12. When Russia invaded Ukraine, it was cut by a further 5 p by the Conservative government as prices rocketed.

It is expected Reeves will scrap that 5p cut, meaning the cost of filling your tank will rise by an average of £3.30.

The government could go further and increase the duty further, something that will be labelled a continuation of Labour’s war on cars by opponents.

Employers’ National Insurance Contributions

While Labour can’t touch National Insurance Contributions for workers without breaking their manifesto pledge, they could increase the rate for employers which currently stands at 13.8 per cent.

If this was raised by one percentage point to 14.8pc, it would bring in an estimated extra £8.5bn a year.

However, critics argue the benefit would not trickle down to workers. Indeed, many businesses would close, while those that stay open might sacrifice employee benefits or lower their pay to make up the deficit.

LATEST FROM MEMBERSHIP:

- EXPOSED: The 48 Labour MPs who made ‘broken promises’ to reduce energy bills pre-election

- Living in a country with 100 per cent inheritance tax is a good thought experiment – Hilary Salt

- ‘Reeves will tax middle Britain – people shouldn’t be punished for investing in their families’ futures,’ says Sally-Ann Hart

‘Sin’ taxes

Reeves is reportedly considering raiding the gambling, alcohol and tobacco industries, the duties on which are known as ‘sin taxes.’

Alcohol duty, which rises in line with the RPI, could be frozen, for example, while a raid on gambling could raise as much as £2.9 billion.

Opponents will point to the dire situation facing many pubs across the country, likewise the damage such a move would cause to cash strapped casinos, seaside resorts and bookmakers.

Labour have already announced a raft of controversial measures designed at least in part to boost the treasury’s bottom line.

They include scrapping the winter fuel payment, worth up to £300, for as many 10 million pensioners in Britain, scrapping the £2 bus fare cap and removing private school’s exemption from VAT.