High-earning parents in the UK are set to lose out on over £20,000 of childcare support annually due to recent government changes, according to new data.

The old Conservative government introduced measures on September 1 to provide 15 hours of free weekly childcare for children aged 9 months to 3 years. However, families where one parent earns more than £100,000 are excluded from this support.

Experts warn that this creates a “tax trap” for high earners. A family with a main breadwinner earning £126,000 could be worse off than one earning £99,000, due to the loss of childcare benefits and other support schemes.

The new system puts high-earning families on a “cliff edge”, as they also miss out on other benefits like the £2,000 tax-free childcare scheme.

To qualify for the new childcare support, each parent must earn between £9,518 and £100,000 annually. There is no limit on combined household income, provided neither parent exceeds £100,000 individually.

The scheme will expand further from September 2025, offering 30 hours of free childcare for all under-fives during term-time.

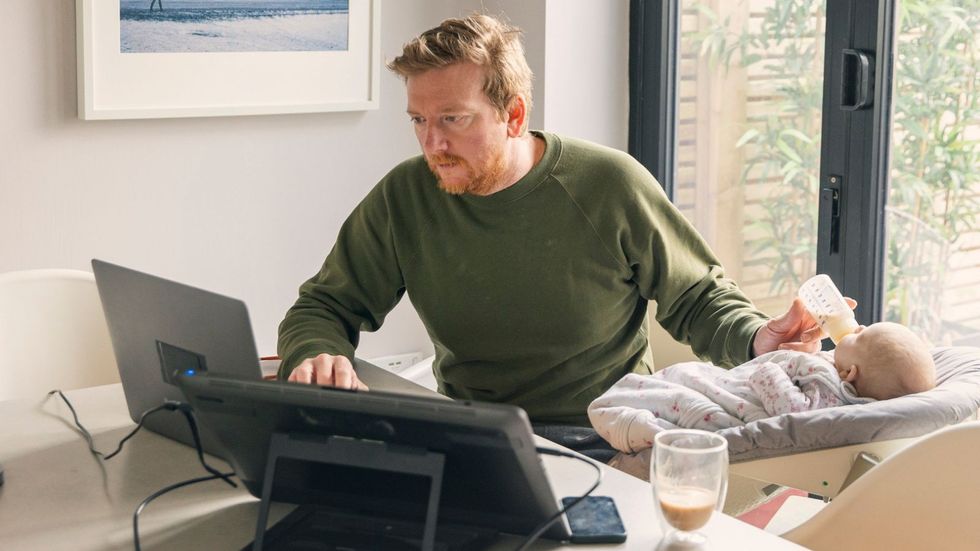

Childcare costs have risen in recent years GETTY

Childcare costs have risen in recent years GETTY Analysis by investment platform AJ Bell has shown the stark impact on high earners.

A family with one high-earning parent and two children under two could lose £20,000 worth of childcare support annually from next academic year, compared to a middle-income family with a main earner on £60,000.

This year, high-earning families are already set to lose £13,000 in support.

Charlene Young, savings expert at AJ Bell, said: “Whilst many working parents will welcome the latest extension of funded childcare hours, a distortion in the tax system means that the cliff-edge for high earning parents will worsen.”

The thresholds for childcare support are based on adjusted net income, which includes earnings, investments, savings, and property income. Bonuses are also factored in.

Ms Young provided an example: “Under the current rules a family with two children aged one and two – where the breadwinner earns £99,000 but gets awarded a bonus of £2,000 – would be classed by the Government as earning an adjusted net income of £101,000.”

This small increase has significant consequences. “Due to the warped rules, this £2,000 pay rise ends up costing them nearly £10,000, an effective tax rate of almost 500pc,” Ms Young explained.

She added that a salary would need to increase to £126,624 to match the disposable income of someone earning £99,000, creating a situation where parents are “effectively worse off earning between £100,000 and £127,000.”

She suggested that families affected by this tax trap could mitigate the impact by increasing pension contributions. This strategy can lower adjusted net income, potentially restoring eligibility for childcare support.

“If you are the parent in that example, paying in just £800 to a pension would lower your adjusted net income by £1,000. That’s £800 plus automatic basic rate tax relief, which gets you back £11,520 and tops up your pension pot by £1,000 too,” she explained.

A Department for Education spokesman responded to concerns, stating: “Quality early education has been unavailable or unaffordable for too long. It’s often the most disadvantaged families that miss out. Fixing this is a major government priority.”

The Government plans to utilise primary school classrooms and recruit more staff to improve early language and maths support.