Every one of London’s local authorities is raising council tax for 2025/26, a shocking map has revealed.

Analysis by GB News has found almost every borough is raising council tax by the legal limit of 4.99 per cent, with Newham securing an 8.99 per cent rise.

It comes after Keir Starmer pledged to freeze council tax if his party won the election in a speech launching Labour’s local election campaign in March 2023.

With Wandsworth only raising council tax by 2.09 per cent, it means there is up to £135 difference between the rate increases across the nation’s capital.

EXPLORE: London Council Tax Rates 2025/26

EXPLORE: London Council Tax Rates 2025/26

EXPLORE: London Council Tax Rates 2025/26

GBN

The largest increase in the borough of Newham comes after Angela Rayner granted the cash-strapped council special permission to raise council tax by 8.99 per cent without the referendumthat is usually required for rises over 4.99 per cent.

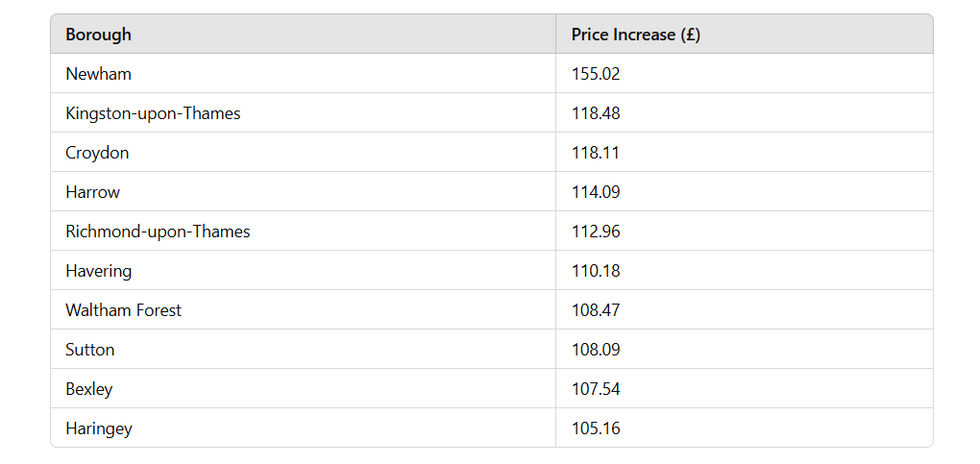

It means Newham residents will be paying £155 more a year in council tax, raising their bills to £1,879 per year (average band D properties).

Other boroughs that are seeing the largest increases include Kingston-upon-Thames (£118), Croydon (£118), Harrow (£114) and Richmond-upon-Thames (£113).

Largest council tax increases (£) in London, 2025/26

Largest council tax increases (£) in London, 2025/26

GBN

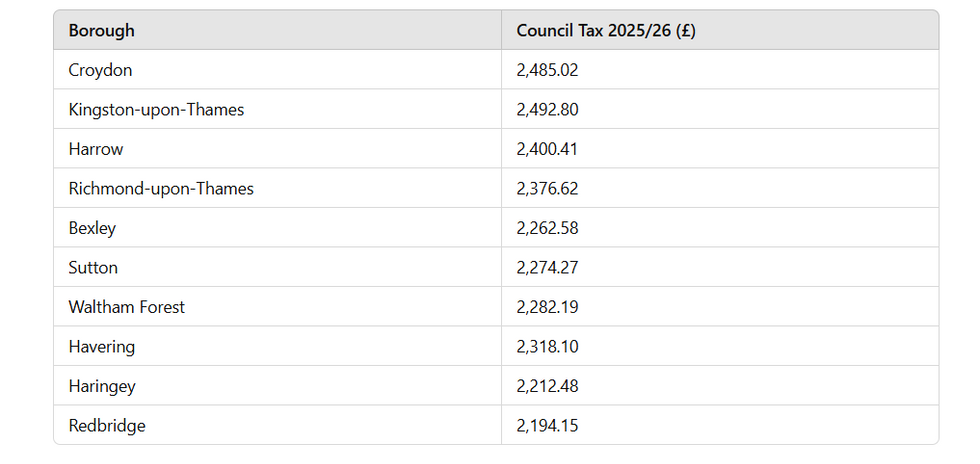

In terms of which boroughs will be paying the most council tax, Croydon takes the top spot with an average bill of £2,485.02 for 2025/26, followed by Kingston-upon-Thames (£2,492.80), Harrow (£2,400.41) and Richmond-upon-Thames (£2,376.62).

Most expensive council tax (£) in London, 2025/26

Most expensive council tax (£) in London, 2025/26

GBN

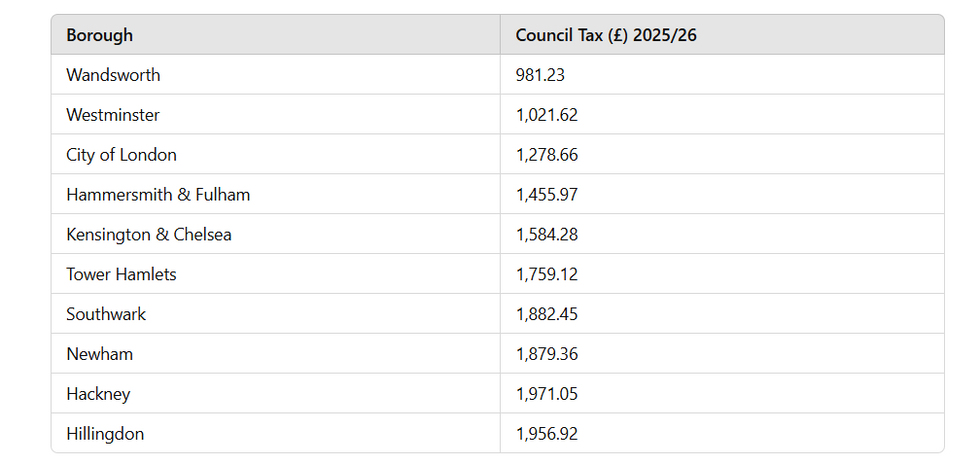

At the other end of the spectrum, Wandsworth in south London is only raising council tax by 2.09 per cent, the lowest of all boroughs.

Smallest council tax increases (£) in London, 2025/26

Smallest council tax increases (£) in London, 2025/26

GBN

It means Wandsworth residents will be paying just £20.09 a year more, keeping the borough as the cheapest in London for council tax in 2025/26.

Wandsworth was followed by some of London’s most affluent areas in terms of cheapest council tax for 2025/26 with Westminster second (£1,021.62), City of London third (£1,278.66), Hammersmith & Fulham fourth (£1,455.97) and Kensington & Chelsea fifth (£1,584.28).

Least expensive council tax (£) in London, 2025/26

Least expensive council tax (£) in London, 2025/26

GBN

As well as significant rate rises, seven London boroughs will also receive Exceptional Financial Support loans totalling more than £418million for the next financial year.

These emergency borrowing measures have been criticised by London Councils who warn they place ‘a burden on boroughs of further debts’ without restoring financial stability.

London Councils, which represents the capital’s local authorities, says boroughs now receive about 28 per cent less funding per Londoner compared to 2010.

The umbrella organisation is calling for council funding to be restored to 2010 levels by 2028-29 which would require a real-terms increase of four per cent every year.

Councils have been scrambling to justify their rises for 2025/26, with most telling voters that statutory laws mean they have to provide certain services and care which is extremely expensive.

LATEST FROM MEMBERSHIP:

However, critics say councils are wasteful and bloated and often employ senior executives on monster six-figure salaries with gold-plated pensions.

Brent council’s leader earns £220k a year – £50k more than the Prime Minister’s salary- for example.

This is in addition to six strategic directors who are paid £110,629 to £180,792, whilst the 13 operational director get £105,189 to £141,766 and 63 heads of services receive between £64,687 to £110,629.

The authority is hiking bills by £101 per year for residents.

A Ministry of Housing, Communities and Local Government spokesperson said councils should “put taxpayers first and carefully consider the impact of their decisions”.

“That’s why we are maintaining a referendum threshold on council tax rises, so taxpayers can have the final say and be protected from excessive increases,” they added.

The Local Government Association, representing councils across England, highlighted that local authorities face “severe funding shortages and soaring cost and demand pressures on local services”.

They said councils had to make a “tough choice” about increasing bills to bring in “desperately-needed” funds.

“However, while council tax is an important funding stream, the significant financial pressures facing local services cannot be met by council tax income alone,” the spokesperson added.

“The Spending Review needs to ensure councils have adequate funding to deliver the services local people want to see.”

RANKED: Council tax increases across London (rates for average band D property)

Newham

Council tax increase – £155

New council tax rate – £1,879.36

Kingston-upon-Thames

Council tax increase – £118

New council tax rate – £2,492.80

Croydon

Council tax increase – £118

New council tax rate – £2,485.02

Harrow

Council tax increase – £114

New council tax rate – £2,400.41

Richmond-upon-Thames

Council tax increase – £113

New council tax rate – £2,376.62

Havering

Council tax increase – £110

New council tax rate – £2,318.10

Waltham Forest

Council tax increase – £108

New council tax rate – £2,282.19

Sutton

Council tax increase – £108

New council tax rate – £2,274.27

Bexley

Council tax increase – £108

New council tax rate – £2,262.58

Haringey

Council tax increase – £105

New council tax rate – £2,212.48

Redbridge

Council tax increase – £104

New council tax rate – £2,194.15

Enfield

Council tax increase – £103

New council tax rate – £2,168.55

Lewisham

Council tax increase – £102

New council tax rate – £2,139.68

Brent

Council tax increase – £102

New council tax rate – £2,137.65

Camden

Council tax increase – £100

New council tax rate – £2,110.90

Barking & Dagenham

Council tax increase – £100

New council tax rate – £2,102.69

Hounslow

Council tax increase – £99

New council tax rate – £2,090.36

Merton

Council tax increase – £99

New council tax rate – £2,092.85

Barnet

Council tax increase – £97

New council tax rate – £2,040.01

Bromley

Council tax increase – £97

New council tax rate – £2,047.00

Ealing

Council tax increase – £97

New council tax rate – £2,045.56

Islington

Council tax increase – £96

New council tax rate – £2,016.36

Greenwich

Council tax increase – £96

New council tax rate – £2,016.19

Hackney

Council tax increase – £94

New council tax rate – £1,971.05

Lambeth

Council tax increase – £93

New council tax rate – £1,958.49

Hillingdon

Council tax increase – £93

New council tax rate – £1,956.92

Southwark

Council tax increase – £89

New council tax rate – £1,882.45

Tower Hamlets

Council tax increase – £84

New council tax rate – £1,759.12

Kensington & Chelsea

Council tax increase – £75

New council tax rate – £1,584.28

Hammersmith & Fulham

Council tax increase – £69

New council tax rate – £1,455.97

City of London

Council tax increase – £61

New council tax rate – £1,278.66

Westminster

Council tax increase – £48

New council tax rate – £1,021.62

Wandsworth

Council tax increase – £20

New council tax rate – £981.23