Rachel Reeves could deliver a number of major changes for motorists in the Budget launching in less than two weeks, including car taxes, fuel rules and more.

Chancellor Rachel Reeves will unveil the Government’s plans for the economy on March 26, 2025, with the Spring Statement, in which she promises to “give families and businesses stability and certainty on upcoming tax and spending changes”.

The Labour MP for Leeds West and Pudsey will unveil her first Spring Statement after committing to delivering just one major fiscal event per year.

To help prepare for the upcoming Spring Statement, GB News has rounded up the potential changes that Chancellor Rachel Reeves could introduce for motorists.

Do you have a story you’d like to share? Get in touch by emailing[email protected]

Chancellor Rachel Reeves could introduce several new motoring rules in the upcoming Spring Statement

GETTY/PA

Car tax

The new financial year in April will see countless car tax changes introduced, many of which were announced by the Chancellor in her October Autumn Statement, or by former Conservative Chancellor Jeremy Hunt.

One of Reeves’s biggest changes in the previous Budget was to “widen the differentials between zero emission, hybrid and internal combustion engine (ICE) cars” through Vehicle Excise Duty changes.

For drivers buying new vehicles after April 1, electric car owners will pay just £10 in the first year, while rates for cars emitting 1-50g/km of CO2, including hybrid vehicles, will increase to £110.

The Chancellor previously introduced car tax measures in the Autumn Statement

GETTY

All other rates for cars emitting more than 76g/km of CO2 will double from their current level, which could see the most polluting petrol and diesel vehicles pay as much as £5,490.

The Government will also hike the standard VED rate for cars, vans and motorcycles, excluding first year rates for cars, in line with inflation from April 1. Electric vehicles will also pay car tax for the first time after former Chancellor Jeremy Hunt said all drivers needed to pay a fair share of motoring taxation.

In a controversial move, the Government confirmed that it would treat double cab pick-up trucks with a payload of one tonne or more as cars for certain car tax purposes, potentially seeing some motorists pay thousands of pounds extra every year.

While the October Budget ruled out introducing changes to the Expensive Car Supplement, the Chancellor could choose to introduce new rules later this month, as the ECS was deemed to have a “disproportionate impact” on those looking to buy an EV.

Petrol and diesel drivers will see the fuel duty freeze extended for a further 12 months

GETTY

Fuel duty

Despite many assuming fuel duty would not be prioritised by the Labour Government, the Chancellor confirmed that she would extend the fuel duty freeze earlier than her Conservative counterparts, in a move welcomed by most drivers.

She outlined that the five pence per litre cut would be extended for a further 12 months, meaning it will now run out in March 2026 unless further changes are introduced.

It was also announced that the planned increase of fuel duty in line with inflation for 2025-26 would be cancelled, with the average driver set to save £59 over the course of the upcoming financial year.

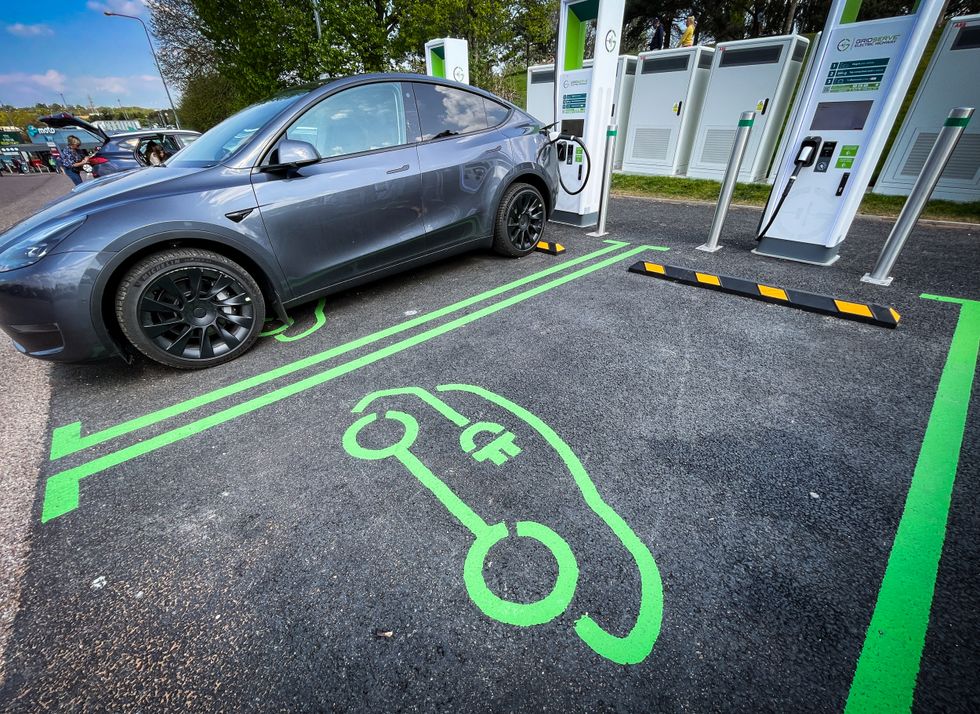

The Government could increase funding for electric vehicles in the upcoming Budget

GETTY

Electric vehicles

The Government has consistently increased funding for electric vehicles in fiscal events, most recently with £200million for the nation’s EV charging infrastructure and £120million for the plug-in van grant and to boost the manufacturing of wheelchair-accessible EVs.

While further funding has not been confirmed, the Chancellor could announce changes or investments for manufacturers aiming to meet the terms of the Zero Emission Vehicle (ZEV) mandate.

The ZEV mandate requires manufacturers to have at least 28 per cent of all new car sales come from electric vehicles, which has split opinions between automakers and industry experts.

Stellantis has confirmed that it will go ahead with the closure of Vauxhall’s Luton factory REUTERS

Stellantis has confirmed that it will go ahead with the closure of Vauxhall’s Luton factory REUTERSCar production

The Chancellor could introduce new measures to protect British industry following a tumultuous year which saw automakers pledge to close factories or delay investment in a massive blow to the nation’s manufacturing industry.

In November, Vauxhall owner Stellantis confirmed plans to invest £50million to strengthen its Ellesmere Port plant, which would result in the closure of its Luton factory and the loss of 1,100 jobs.

BMW also confirmed last month that it would be delaying a significant £600million upgrade to its Oxford Mini plant as a result of “multiple uncertainties facing the automotive industry”.

LATEST DEVELOPMENTS:

- Ford could restrict sales of petrol and diesel cars amid pressure of strict electric vehicle targets

- Heavy electric cars may crash through motorway safety barriers with ‘lives at risk’ amid calls for action

- Major car brand refuses to roll out electric vehicle until 2030s – ‘Not an immediate priority’

There are hopes that the Fuel Finder tool will launch in the coming months

PA

Fuel Finder

As confirmed in the Autumn Statement, the Government will look to launch the long-awaited Fuel Finder tool to help petrol and diesel drivers save money.

There are expectations that it will launch before the end of the year, with modelling estimating that drivers could save between one and six pence per litre.

It is likely to be similar to the Consumer Council’s Fuel Price Checker used in Northern Ireland, which sees motorists save around 6p per litre for petrol and 7p for diesel.