The Central Bank of Ireland has been accused of “complicity in genocide” over its EU role in approving Israel Bonds for sale in the EU.

Protesters called for new legislation that would give Ireland the power to refuse their sale over human rights concerns.

Israel chose the Central Bank of Ireland to be the designated authority to approve prospectuses for the securities in the EU, having used the UK before Brexit.

Israel Bonds are advertised as supporting the country’s economy.

More recently, websites promoting the bonds emphasise their role in supporting Israel during the war.

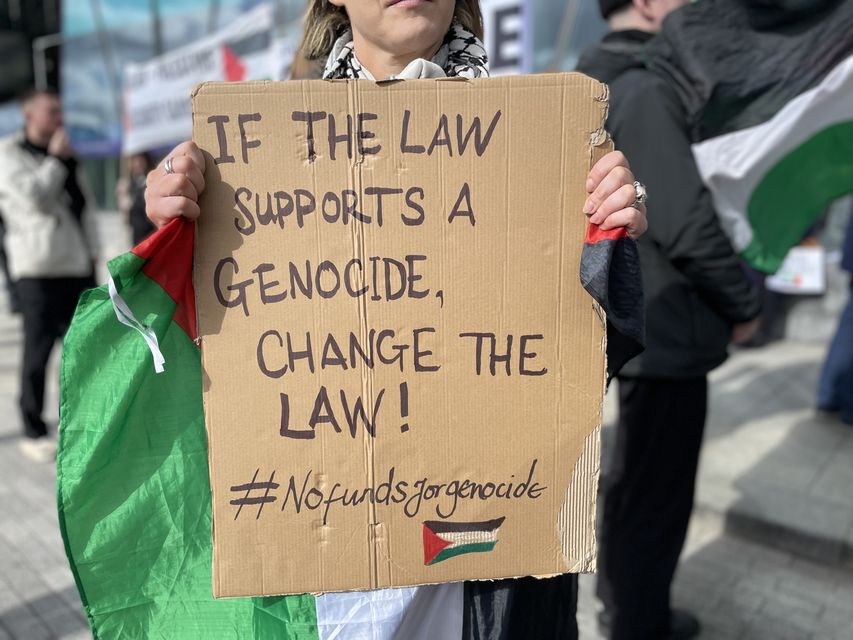

A member of the public holds a sign during a pro-Palestine protest outside the Central Bank in Dublin (PA)

The Central Bank is responsible for assessing whether a prospectus for the offer of securities is in compliance with requirements of the EU Prospectus Regulation.

Dublin’s Central Bank said approval should not be viewed as “an endorsement of the issuer”.

On Tuesday, a protest was held outside the Central Bank’s offices, with activists calling for laws to allow Ireland to refuse the sale of what they called Israel’s “war bonds”.

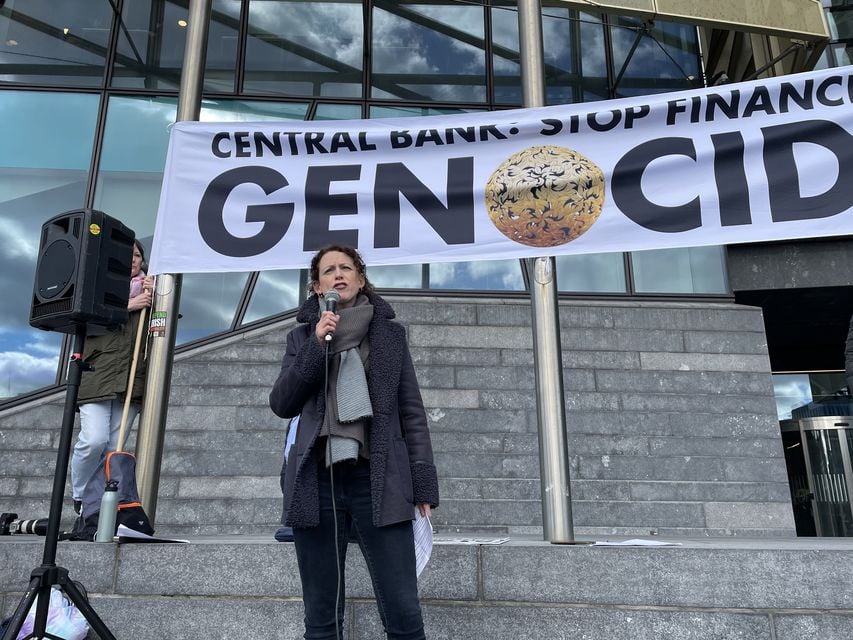

Helen Mahony, an organiser with the Ireland Palestine Solidarity Campaign (IPSC), said: “It is an abomination that Central Bank is funding genocide.

Ireland-Palestine Solidarity Campaign organiser Helen Mahony holds a sign during the demo (PA)

“It is entirely absurd that the governor of the Central Bank said that nothing applies to him or the Central Bank except to the EU prospectus.

“Imagine that, no law in the land applies to him, no human rights law. The Genocide Convention doesn’t apply – of course it does apply.

“The Central Bank is obliged not to be complicit in genocide. They are actually breaking the law and they need to stop breaking the law.”

Labour TD Marie Sherlock said the Central Bank’s role in approving Israel Bonds on behalf of the EU “to fund the war effort in Palestine is an abomination”.

She added: “It is an absolute outrage and completely unacceptable that as a country, any agency or organ of this state would be complicit in a genocide of a people, let alone the Palestinian people.”

Labour TD Marie Sherlock addressed protesters (PA)

She said questions put to the Minister for Finance prompt the same “claptrap and nonsense” response that EU regulations bind the Central Bank in its response.

“That has to end,” she said, “we have to ensure that legislation is brought in so that we are not bound by EU regulation.”

People Before Profit councillor Darragh Adelaide said EU law is used as an excuse for authorities to “absolve themselves of responsibility”.

He said Ireland should not approve Israeli bonds in the hope it influences other countries and the EU.

“If the law does not allow you to take action in the face of a genocide, then that law needs to be broken, it’s not fit for purpose, we need to ignore them, we need to take action.”

People Before Profit councillor Darragh Adelaide also spoke during the protest (PA)

Solidarity TD Ruth Coppinger told the protest she had only recently heard of the Central Bank’s role in approving the sale of Israeli bonds.

“The fact that Ireland is the clearing house, the agent for the whole of the EU, for these bonds, in a so-called neutral country, is absolutely scandalous,” she said.

“Israeli bonds have raised 4 billion since the genocide began. These are essentially loans by states to the Israeli regime. Loans for what? Loans for genocide.”

She said pressure needs to be put on workers in the financial sector not to co-operate with Israel Bonds using the landmark opinion in July from the International Court of Justice as their basis.

“These are war bonds that the Central Bank is dealing in,” she added.

Solidarity TD Ruth Coppinger described the situation as ‘absolutely scandalous’ (PA)

A spokeswoman for the Central Bank said granting approval is not an “endorsement of an issuer”.

She added: “As the competent authority under the prospectus regulation, the Central Bank is responsible for assessing whether a prospectus has been drawn up in compliance with the disclosure requirements of the prospectus regulation.

“We are required to approve the prospectus under the prospectus regulation where the prospectus documentation meets standards of completeness, consistency and comprehensibility.

“Approval should not be considered as an endorsement of the issuer and the securities that is the subject of the prospectus. The Central Bank will adhere to any financial sanctions or restrictive measures that are imposed under law.”

The protest on Tuesday came a day after a small pro-Palestine demo occupied the Central Bank’s offices on the capital’s quays for more than an hour.

The protesters walked through the visitor centre before reaching the lobby and chanted “Free Palestine”.