A new analysis has revealed how much the average farm will owe the taxman under the new inheritance rules – and how long it will take to pay back what is owed.

It comes after farmers staged another protest in central London last week over Rachel Reeves’ proposed changes to inheritance tax reliefs.

From April 2026, taxes would apply to agricultural assets over £1million (or up to £3million in certain circumstances).

The government has said this would just affect the wealthiest landowners and disincentivise buying agricultural land to avoid tax.

However, farming groups have argued the policy is a threat to the future of family farming and the UK’s food security.

Now, data from law firm Weightmans suggests farmers have good reason to be worried. Thousands of family-run farms across the UK could be forced to sell land or shut down as the government introduces a new inheritance tax (IHT) levy.

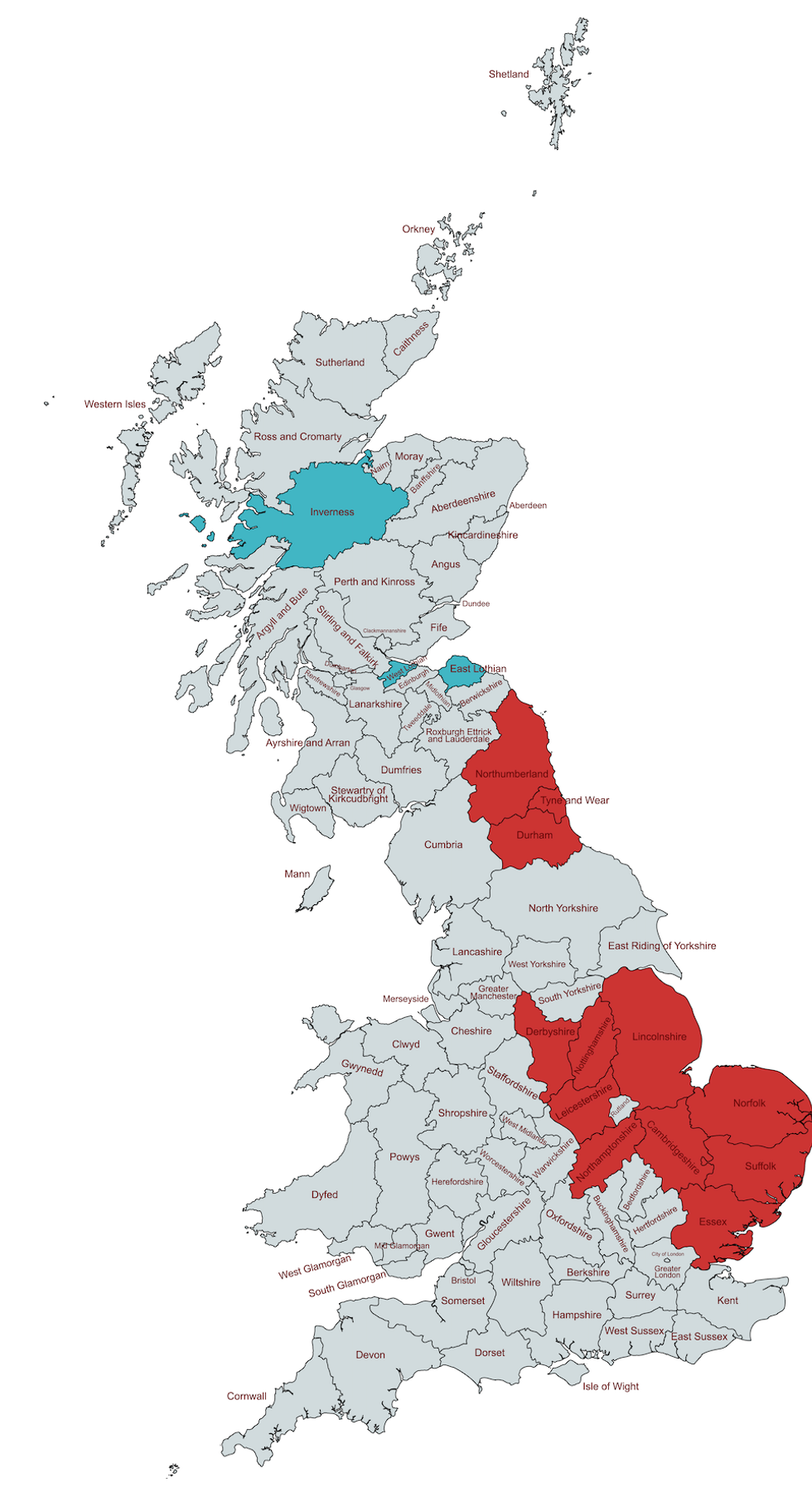

Farmers in the North East, East of England and East Midlands will face heavy tax liabilities

MapChart

Who will be hit hardest?

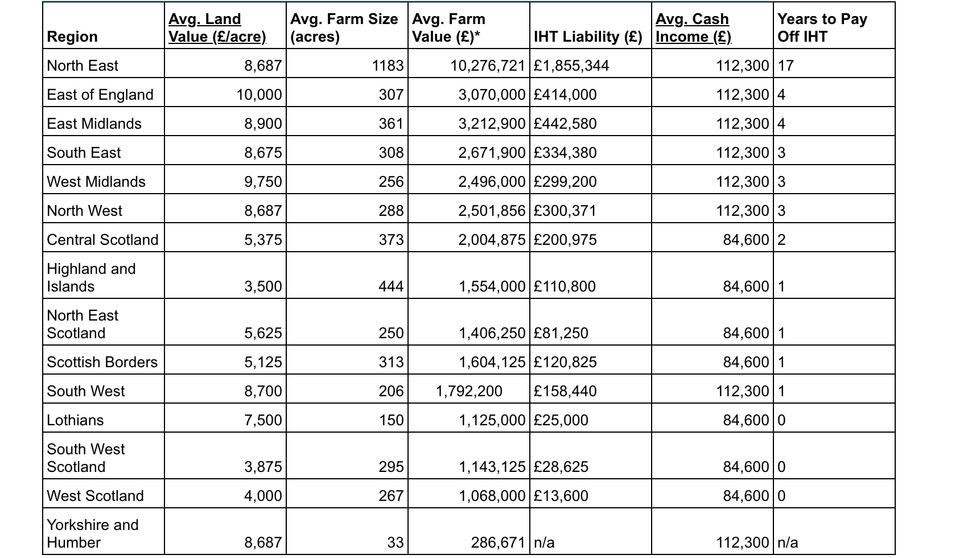

Farming profits vary significantly across the UK, as do land values, which are often the biggest asset in an estate.

By estimating the average value of farms in each region and applying the new IHT rules, Weightmans determined how long it would take farmers to pay off any inheritance tax.

The law firm’s analysis indicates that on the average farm, farmers could expect a tax bill of over £313,242 — which would take over three years of cash income to pay back.

While larger farms can have significantly higher tax values, this doesn’t match up with the income that these farms are making.

These regional differences in farmland values and inheritance tax (IHT) liabilities reveal a clear pattern, particularly across England.

For example, in the North East (see map), where the average farm size is 1,183 acres, total farm values reach over £10million, leading to an IHT liability of £1.85 million.

With an average farm income of £112,300, it would take an estimated 17 years of earnings to settle this tax burden.

Similarly, in high-value regions like the East of England and East Midlands, farm values exceed £3 million, with tax liabilities surpassing £400,000, taking an estimated four years to pay off.

This stands in stark contrast to areas such as West Scotland and the Lothians, where lower land values and smaller farm sizes mean IHT liabilities are as low as £13,600 and £25,000, respectively—amounts that could be covered within a single year’s income.

LATEST MEMBERSHIP DEVELOPMENTS

- Did Elon Musk ‘put a target’ on Rupert Lowe’s back? Nigel Farage feud takes surprising turn as row heats up

- ‘I invest in weapons your enemies want right now – Donald Trump just risked a doomsday clash with China’

- Brexit Britain poised for huge victory as three shock graphs put EU on Donald Trump’s hit list

West Scotland and the Lothians will have far lower liabilities

Weightmans

In this region, farm owners can expect tax liabilities ranging from three to seventeen years’ worth of their cash income, making estate planning crucial to avoid financial strain.

In contrast, the South West — including areas such as Cornwall — has above-average land values but smaller farm sizes. As a result, while IHT liabilities still exist, they are significantly lower than in the East.

In many cases, these tax obligations could be covered within a single year’s worth of cash income, presenting a far more manageable financial outlook for farming families in the region.

Naomi Woods, Partner at Weightmans, said: The proposed inheritance tax reforms pose a serious threat to the future of family-run farms across the UK. With many agricultural estates exceeding the £1 million threshold, these changes could leave farming families facing tax bills of up to £300,000, sums that cannot be met through annual profits alone. This risks forcing farms to sell land, and livestock, or even shut down entirely. Given the scale of the challenge, it is crucial that farmers take immediate steps to review their estate plans, explore potential tax reliefs, and consider restructuring ownership to protect their businesses for future generations. Without careful planning, this tax could accelerate the decline of traditional British farming.”