Nigel Farage has pledged to abolish inheritance tax in Britain if Reform UK wins power at the next election.

The Brexit-supremo made the claim at the recent farming protest during an interview with GB News.

Farage was lending his support to farmers who are locking horns with Chancellor Reeves over her proposed changes to inheritance tax.

Rachel Reeves slapped farmers with 20 per cent death duties on assets over £1million sparking fury from cash-poor asset-rich farmers who say the tax will wipe out profits, start a rural recession and lead to many farmers selling up.

Farage pledged to abolish inheritance tax at the farming rally on Monday

GB NEWS

Farage fumed against the government: “They are hopelessly out of touch. They want to control. They literally want to stop us eating meat, stop us flying on holiday, stop us living their lives. Do you know what? They can go to hell.”

When pressed by presenter Emily Carver on what Reform UK’s policy would be on inheritance tax more widely, Farage made clear that they would “get rid” of the tax completely.

The Brexit-supremo explained: “Inheritance tax is double taxation. People have paid tax on this already, why on Earth when they die should they be taxed again? We would get rid of inheritance tax.

“It’s a really nasty tax and it hits people at the most unpleasant part of their lives. They just lost their parents and suddenly the taxman is after them. So we would get rid of inheritance tax.”

Nigel Farage also attacked climate change

GB News / PA

How much could you save?

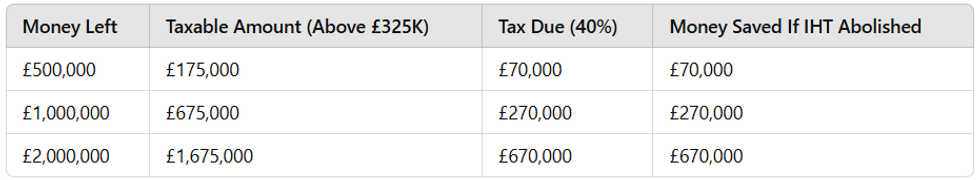

Inheritance Tax (IHT) is a tax on the estate (money, property, and possessions) of someone who has died.

The standard rate is 40 per cent, but it only applies to the portion of the estate that exceeds the £325,000 tax-free threshold (also known as the “nil-rate band”).

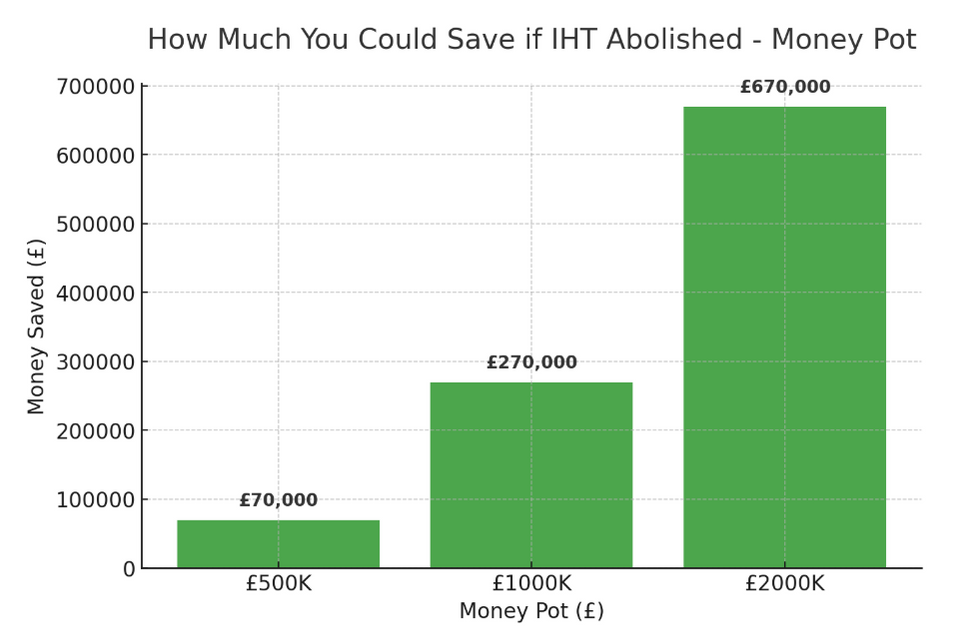

Applying this to the inheritance of money pots we can see how much money is usually lost to IHT and therefore how much would be saved under Farage’s abolition.

It reveals that for someone passing on £1million, £270,000 would have gone to the taxman and now would be saved.

How much could you save? Money pot

How much could you save? Money pot

GBN

How much you could save – money pots

How much you could save – money pots

GBN

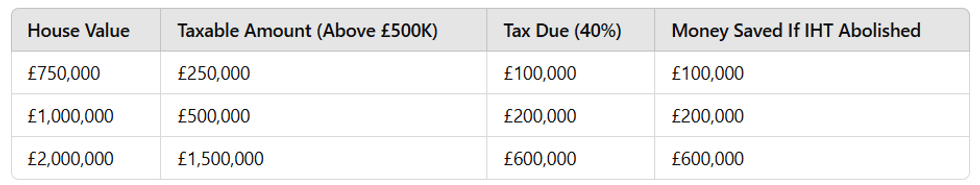

Houses are another part of an estate commonly subject to IHT as they are usually worth more than the nil-rate band.

There is an important exemption, however. If you leave your home to your children or grandchildren, you get an extra £175,000 tax-free allowance, bringing the total tax-free amount to £500,000.

With that in mind we can see how much money is usually lost to IHT and therefore how much would be saved under Farage’s abolition.

If the house is left to someone other than a direct descendant (a sibling or friend), the taxable threshold drops back to £325,000, increasing the tax bill.

It reveals that for someone passing on £2million home, £600,000 would have gone to the taxman and now would be saved.

How much could you save? House

How much could you save? House

GBN

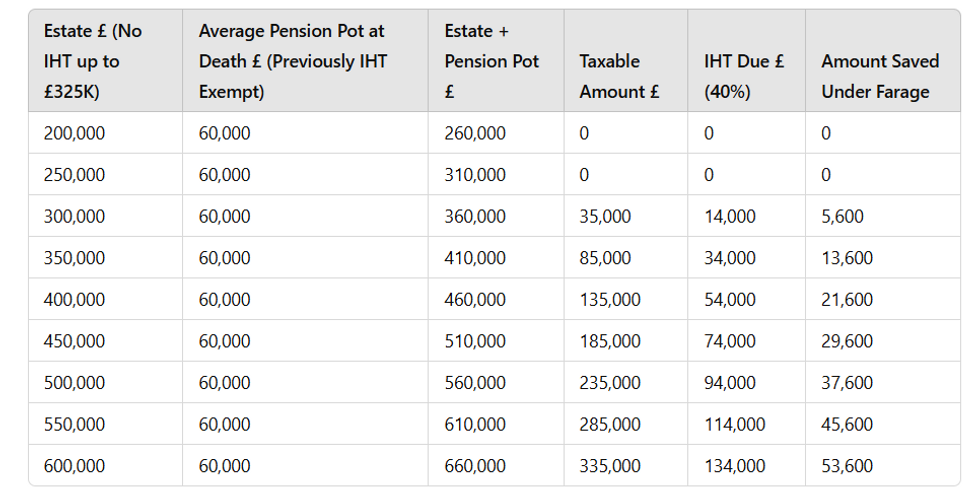

One of Reeves’ big budget measures was to include unused pension funds in the value of an individual’s estate for IHT purposes.

Taking the average amount left in a pension point at the point of death (£60,000) and adding it to different sized estates, we can see how much IHT will be due under Reeves new rules.

The amount due is also the amount that would be saved under Farage’s plans.

It reveals that for someone passing on a pension of £500,000, £285,000 would have gone to the taxman and now would be saved.

LATEST FROM MEMBERSHIP:

How much could you save? Pension pot

How much could you save? Pension pot

GBN

Obviously, Nigel Farage could only enact such a measure if he were to win power and there is four years until the next general election.

However, recent national polls have revealed Reform would win the most votes and the most seats if an election was called tomorrow.

In a poll by Electoral Calculus, Nigel Farage’s Reform UK party has polled at 25.8 per cent, with Labour behind on 24.7 per cent and Kemi Badenoch’s Conservative party in third on 21.9 per cent.

The new opinion poll would place Reform UK on 192 seats, with Labour on 178 seats down from 404, with the Conservative party trailing on 142 seats and no longer the official opposition.

There is also the fact Reform is on the cusp of winning the most seats in Wales’ elections in May 2026.

Inheritance tax is not within the jurisdiction of the Welsh government, but Farage could blame Labour in Westminster.

Responding to the poll, a Reform UK spokesman said: “This polling confirms what we all know, Reform has all the momentum in British politics.

“The British people are ready for real change after decades of deception and failure by the Tories and Labour.

“This is only just the start, we intend to win the next general election.”

Abolishing inheritance tax, often dubbed as Britain’s most hated tax, would likely win much support but Reform is yet to point out how they make up for the lost tax receipts for the Treasury.