Almost half of councils in Britain raised council tax last year while also adding to their financial reserves, according to new research.

The study found that 47.2 per cent of councils that published their 2023-24 accounts increased their usable reserves instead of spending the money.

New research from the TaxPayers’ Alliance (TPA) has raised concerns that some councils are choosing to increase council tax just to increase reserves.

Local councils build up reserves for different reasons, such as protecting against unexpected financial problems or setting aside funds for future projects and services.

The research comes as many councils across the UK increased their council tax bills by higher than expected, claiming they were dealing with financial hardship as a way to justify the tax increases.

The findings have sparked fury among taxpayers who face above-inflation tax hikes while councils appear to be stockpiling cash.

The highest council tax increases came from financially troubled authorities including Croydon (14.99 per cent), Thurrock (9.99 per cent) and Slough (9.99 per cent).

Tax bills could rise substantially this year as a result of the struggling councilsGETTY

Tax bills could rise substantially this year as a result of the struggling councilsGETTYShimeon Lee, policy analyst of the TaxPayers’ Alliance, said: “Local taxpayers will rightly be concerned that some councils are filling their coffers at the expense of residents.

“For many years, town halls have consistently increased council tax and justified the rises with claims of financial hardship. These figures reveal that a significant number of local authorities are hoarding cash while local people struggle to make ends meet.

“Ministers must look to curb the practice of building excessive reserves while councils need to provide greater transparency for their residents and keep tax rises to a minimum.”

The research highlighted stark contrasts between councils that raised taxes while building reserves and those that managed to freeze rates.

LATEST DEVELOPMENTS:

- Council tax alert: Labour proposal to raise rate to maximum amount REJECTED: ‘Irresponsible!’

- Council tax slammed as the new ‘POLL TAX’ as levy ‘consuming large share’ of Britons’ incomes

- Council tax raid: Over two million Britons face higher than usual tax hikes as Labour makes ‘tough decisions’ across UK

Conwy saw the largest cash terms increase in council tax, which rose by £161 or 8.91 per cent in 2023-24, while simultaneously growing usable reserves by £8.5million (17 per cent).

Powys followed with a council tax rise of £100 or 5.5 per cent, while increasing reserves by £1million. By contrast, East Cambridgeshire and South Norfolk both managed to freeze council tax in 2023-24 while still increasing their usable reserves by £2.4million and £8.3million, respectively.

These examples raise questions about whether tax increases were truly necessary.

The research revealed that local authorities had an average of £779 in usable reserves per resident as of March 2024. Three councils had extraordinarily high reserves exceeding £10,000 per resident: the City of London (£31,414), Shetland Islands (£17,548) and Orkney Islands (£11,512).

The council which saw the greatest increase in usable reserves was Epping Forest, adding £86million in 2023-24. This windfall came from the sale of land at North Weald Airfield which raised £88.2million.

Milton Keynes recorded the second-largest increase, with reserves growing by £78.8million (29 per cent) in 2023-24. During this same period, Milton Keynes raised council tax by 4.99 per cent.

The TPA research also found that 52 councils increased their reserves in both 2022-23 and 2023-24. This pattern contradicts claims from local authority leaders who previously stated they were drawing down reserves to remain solvent.

The TPA is calling for several reforms to local Government finances to address these issues.

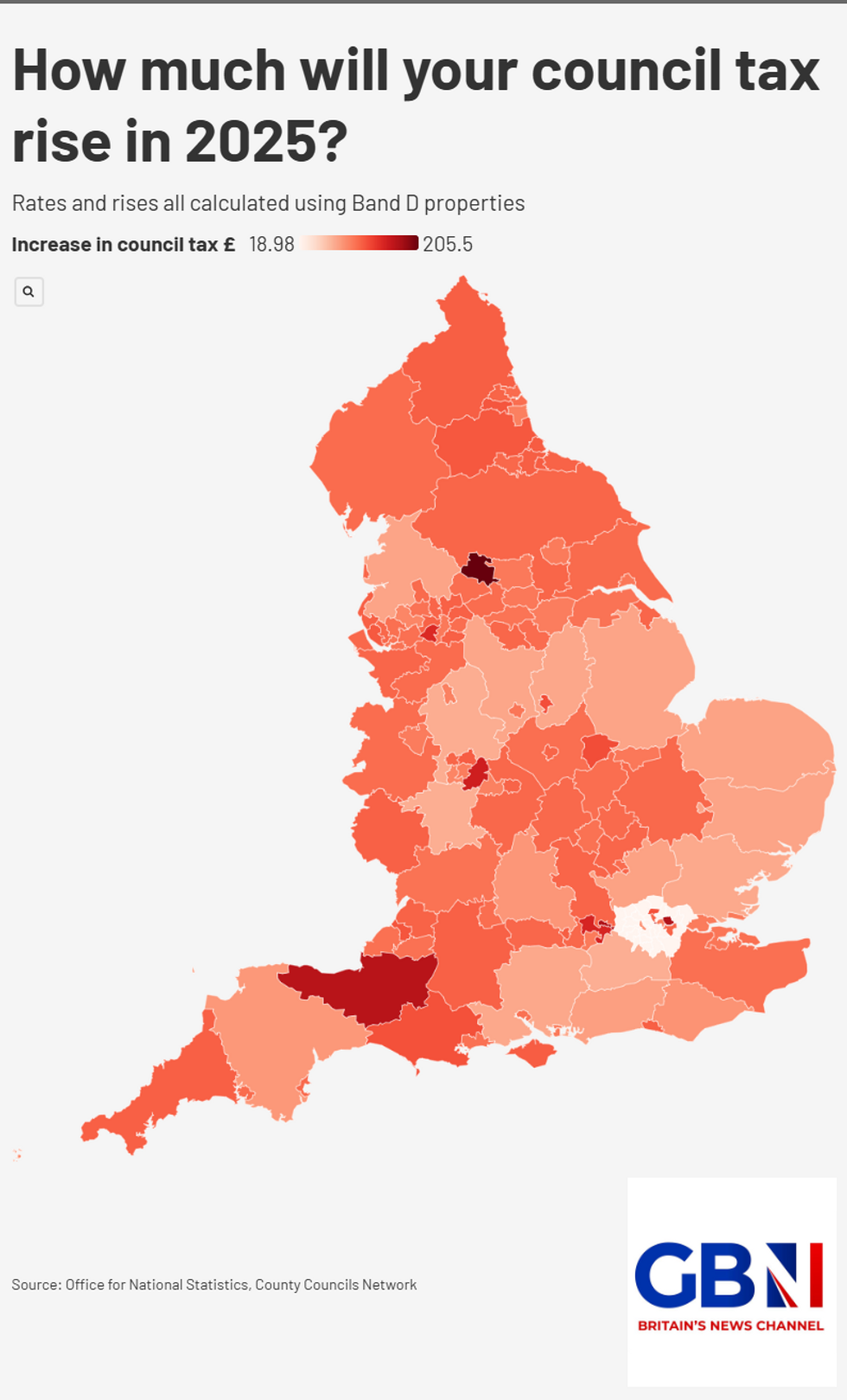

Council tax rises 2025/2026GBN

Council tax rises 2025/2026GBN

They propose expanding referendum criteria to curb excessive reserve accumulation, requiring councils with large cash reserves to justify tax increases to residents. This would trigger public votes when councils attempt to raise taxes while holding substantial reserves.

The alliance also wants greater transparency, with councils publishing standardised, easy-to-understand breakdowns of revenue and expenditure.

Additionally, the TPA advocates giving councils more flexibility in how they use their reserves, arguing local authorities better understand their specific needs.

These reforms aim to increase accountability and prevent unnecessary tax increases when councils have sufficient savings.