Nationwide Building Society has announced a major change to its line of mortgage products in a win for homeowners and prospective homebuyers.

The high street lender is cutting interest rates by up to 0.25 percentage points across selected two, three and five-year fixed rate products from February 28.

As a result, Nationwide’s lowest mortgage rate now sits at 3.99 per cent, which is available to current customers who want to switch deals or those looking to remortgage.

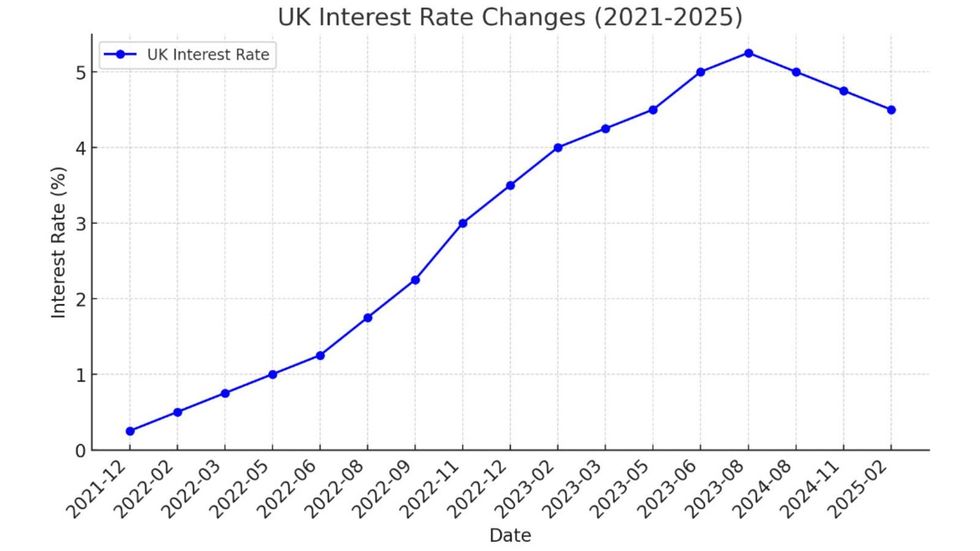

This comes after the Bank of England’s recent decision to slash the base rate from 4.75 per cent to 4.5 per cent, easing the cost of borrowing.

Analysts are pricing in further interest rate cuts throughout the year with lenders likely to make changes to their mortgage offerings in response.

Do you have a money story you’d like to share? Get in touch by emailing [email protected].

Nationwide Building is slashing mortgage rates

NATIONWIDE BUILDING SOCIETY

Here is a full list of the changes to switcher deals following Nationwide Building Society’s latest cut to mortgage rates:

- Five-year fixed rate at 60 per cent LTV with a £999 fee is 3.99 per cent (reduced by 0.13 per cent)

- Two-year fixed rate at 60 per cent TV with a £999 fee is 4.09 per cent (reduced by 0.15 per cent)

- Five-year fixed rate at 75 per cent LTV with no fee is 4.32 per cent (reduced by 0.17 per cent)

Here is a full list of changes to remortgage deals following Nationwide Building Society’s latest cut to mortgage rates:

- Five-year fixed rate at 60 per cent LTV with a £1,499 fee is 3.99 per cent (reduced by 0.13 per cent)

- Two-year fixed rate at 60 per cent LTV with a £1,499 fee is 4.09 per cent (reduced by 0.15 per cent)

- Five-year fixed rate at 60 per cent LTV with no fee is 4.24 per cent (reduced by 0.14 per cent)

Many Britons are looking to get on the property ladder

GETTY

Here is a full list of the changes for first-time buyers following Nationwide Building Society’s latest cut to mortgage rates:

- Five-year fixed rate at 90 per cent LTV with a £999 fee is 4.74 per cent (reduced by 0.25 per cent)

- Two-year fixed rate at 85 per cent LTV with no fee is 4.99 per cent (reduced by 0.06 per cent)

- Three-year fixed rate at 75 per cent LTV with a £999 fee is 4.39 per cent (reduced by 0.05 per cent)

- Five-year fixed rate at 60 per cent LTV with a £1,499 fee is 4.02 per cent (reduced by 0.07 per cent)

- Three-year fixed rate at 60 per cent LTV with a £999 fee is 4.09 per cent (reduced by 0.10 per cent)

- Five-year fixed rate at 85 per cent LTV with a £999 fee is 4.39 per cent (reduced by 0.06 per cent)

Here is a full list of the changes for customers moving home following Nationwide Building Society’s latest cut to mortgage rates:

- Five-year fixed rate at 60 per cent LTV with a £1,499 fee is 4.02 per cent (reduced by 0.07 per cent)

- Three-year fixed rate at 60 per cent LTV with a £999 fee is 4.09 per cent (reduced by 0.10 per cent)

- Five-year fixed rate at 85 per cent LTV with a £999 fee is 4.39 per cent (reduced by 0.06 per cent)

The Bank of England has made multiple changes to the base rate over the years CHAT GPT

The Bank of England has made multiple changes to the base rate over the years CHAT GPT Carlo Pileggi, Nationwide’s senior manager for Mortgages, said: “Our third set of rate cuts in three weeks should come as great news for borrowers.

“We remain as committed as ever to supporting all segments of the market, including those buying their first home or moving to their next.

“With our switcher and remortgage rates starting from 3.99 per cent, we aim to be front of mind for those looking for a new deal too.”

The Bank of England’s next base rate announcement is scheduled to take place on March 20.