Yorkshire Building Society has announced significant cuts to its mortgage interest rates for the second time this week, with reductions of up to 0.97 per cent across its product range.

The building society has implemented rate reductions across various loan-to-value (LTV) products, including cuts of up to 0.12 per cent for mortgages up to 60 per cent, 75 per cent, 80 per cent and 90 per cent LTV.

According to YBS, the most substantial reductions target borrowers with lower deposits, with products up to 95 per cent LTV seeing cuts of up to 0.97 per cent per cent.

Major lenders, including Santander and Barclays, have begun slashing rates attached to mortgage products following the Bank of England’s decision to slash the UK’s base rate last week.

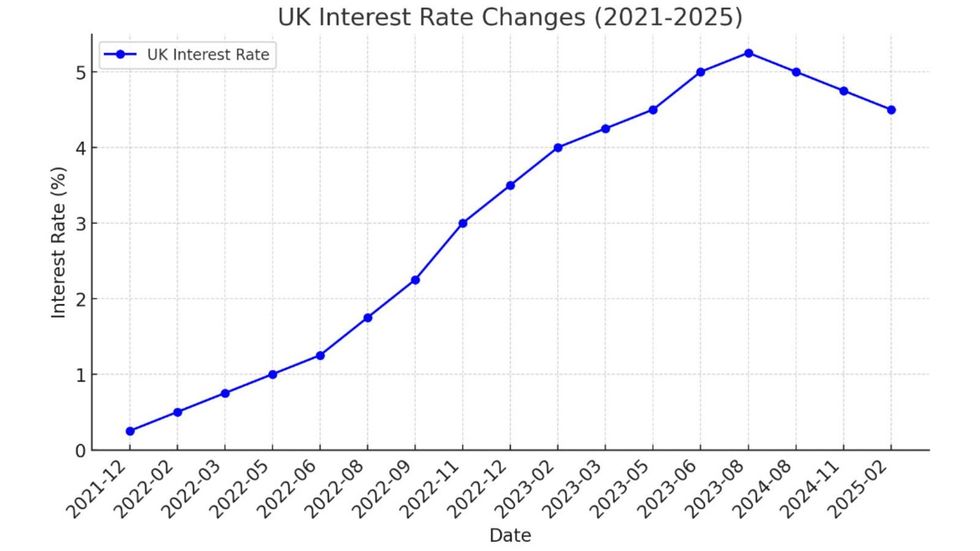

The central bank’s Monetary Policy Committee (MPC) slashed the country’s cost of borrowing from 4.75 per cent to 4.5 per cent in a big win for those navigating the property market.

Do you have a money story you’d like to share? Get in touch by emailing [email protected].

Yorkshire Building Society has cut mortgage rates once again

PA

Here is a list of the “highlights” from Yorkshire Building Society’s latest round of mortgage rate cuts:

- A two-year fixed-rate mortgage to 75 per cent LTV, for remortgage purposes, at 4.27 per cent (was 4.39 per cent), with a £995 fee, free standard valuation and remortgage legal services

- A two-year fixed rate to 75 per cent LTV, for house purchase, at 4.44 per cent (was 4.56 per cent), with a £495 fee and free standard valuation

- A five-year fixed rate to 80 per cent LTV, for house purchase, at 4.30 per cent (was 4.42 per cent), with a £995 fee and free standard valuation

Mortgage repayments have shot up for many borrowers in recent years GETTY

Mortgage repayments have shot up for many borrowers in recent years GETTYCheryl Bleasdale, a product manager at Yorkshire Building Society’s, broke down the offering: “We’re delighted to be able to cut our rates again so soon after our last decrease.

“Market rates have provided us with this golden opportunity over the past week and we will continue to watch developments closely and act where we can to help our borrowers save money.”

Rachel Springall, a finance expert at Moneyfactscompare, added: “It’s fantastic to see Yorkshire Building Society make more cuts to fixed rates within its mortgage range.

“There are millions of borrowers due to refinance this year, so it’s positive to see borrowers to see cuts, particularly on deals which also carry cost-saving incentives.

“The latest rate reductions follow the Bank of England’s decision to cut the base rate from 4.75 per cent to 4.5 per cent.”.

Jenny Ross, the editor of Which? Money, cautioned that despite the rate cut, mortgage rates are unlikely to fall dramatically.

“Though the decision to cut interest rates again will offer some small relief to those remortgaging or buying, many households may still be concerned about meeting their repayments,” she said.

LATEST DEVELOPMENTS:

The Bank of England has made multiple changes to the base rate over the years CHAT GPT

The Bank of England has made multiple changes to the base rate over the years CHAT GPT Ross advised homeowners concerned about payments to contact their mortgage lenders, who are obligated to provide assistance.

“Lenders may be able to suggest alternative payment options, such as a temporary payment holiday or only paying the interest on repayments,” she explained.

She also urged savers to review their accounts, noting that digital banks and building societies typically offer better rates than traditional high street banks.

“Remaining loyal to one provider could be a costly mistake,” Ross warned.