Santander has announced a major overhaul to its range of mortgage products and savings accounts following the Bank of England’s interest rate announcement earlier today.

The central bank’s Monetary Policy Committee (MPC) voted seven-to-two to slash the base rate, which determines the cost of borrowing, from 4.75 per cent to 4.5 per cent in a move that impacts banks, building societies and lenders.

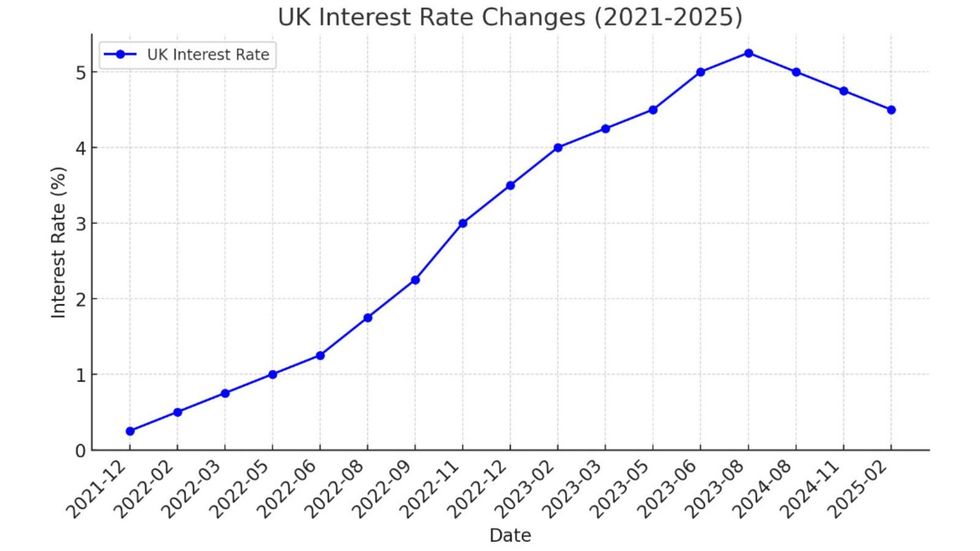

Interest rates have been raised by the Bank in recent years in an attempt to rein in the consumer price index (CPI) rate of inflation, which has soared to as high as 11.1 per cent.

With inflation falling closer to the Bank of England’s target of two per cent, MPC policymakers are beginning to cut rates down to pre-pandemic levels which impacts peoples finances.

Savings accounts have benefited from bolstered returns over this period, however mortgage holders have been saddled with hiked monthly repayments due to higher interest.

Do you have a money story you’d like to share? Get in touch by emailing [email protected].

Santander is cutting mortgage and savings rates

GETTY

Analysts are sounding the alarm that high street banks and building societies are likely to cut interest rates attached in response to the Bank of England’s actions today.

However, property owners and prospective homebuyers are likely to be awarded some reprieve as rates linked to mortgage products are expected to come down as well.

Ahead of today’s base rate announcement, multiple lenders confirmed plans to slash mortgage rates ahead of the MPC meeting with Santander the latest financial institution to do so.

In addition, the bank has confirmed plans to cut savings rates on accounts linked to the Bank of England base rate in a blow to those looking to bolster their finances.

The Bank of England has made multiple changes to the base rate in recent years

CHAT GPT

Here is a full breakdown of the changes to mortgage products being implemented by Santander:

- All of the bank’s existing tracker mortgage products linked to the base rate will decrease by 0.25 per cent from March 3, 2025. This includes the Santander Follow-on Rate (FoR) which will decrease to 7.75 per cent from eight per cent

- Furthermore, the Santander Standard Variable Rate (SVR) will also fall by 0.25 per cent to 6.75 per cent from seven per cent on the same day.

- All Santander savings products that are linked to the Bank of England base rate will drop by 0.25 per cent, effective from March 3, 2025

- Among the products linked to the base rate are the Rate for Life and Good for Life savings accounts.

David Morrison, a senior market analyst at FCA-regulated fintech and financial services provider, Trade Nation, broke down the likely winners from the central bank’s announcement today.

He shared: “As expected, the Bank of England has cut its key interest rate to 4.5 per cent today by a majority vote of seven-to-two. The two votes against this were to actually drop the Bank Rate by 0.5 percentage points, to 4.25 per cent, highlighting that further cuts could come through the rest of the year.

LATEST DEVELOPMENTS:

Savings interest rates are being cut following recent actions from the Bank of England GETTY

Savings interest rates are being cut following recent actions from the Bank of England GETTY

“This additional cut is great news for home owners on variable or tracker mortgages, or for those looking to either buy their first home or re-mortgage, as high-street banks are likely to offer lower mortgage rate products. It’s predicted that this could bring the average mortgage cost down by £29 per month.

“The lowered rate may also impact stock markets positively, as these lower borrowing costs will in turn encourage business expansion and consumer spending. This has already been demonstrated after the FTSE 100 hit an all-time high this morning, with UK multinationals benefitting from a steep fall in sterling.

“Sectors like real estate, consumer discretionary, and financials are likely to benefit the most, as lower interest rates reduce mortgage costs and increase corporate profitability. However, banks may now see lower net interest margins, which could pressure their stock prices.”

The Bank of England’s next MPC meeting is scheduled to take place on Thursday, March 20, 2025.