Rachel Reeves “must scrap her misguided jobs tax” as the UK labour market is under “major threat” following tax changes in the Autumn Budget, leading economists have cautioned.

New figures today show that there is mounting pressure on Britain’s labour market, with unemployment rising and warnings of significant job losses ahead.

The stark warning comes as Office for National Statistics data shows the unemployment rate has climbed to 4.4 per cent, while the number of workers on company payrolls has suffered its steepest drop since the pandemic.

Daisy Cooper MP, Liberal Democrat Treasury spokesperson said: “These latest figures are concerning. The Government’s misguided jobs tax is already scaring off small businesses from hiring new people and being able to better serve our communities.

“The Chancellor talks about growth but her Budget measures are acting as an anchor against just that.”

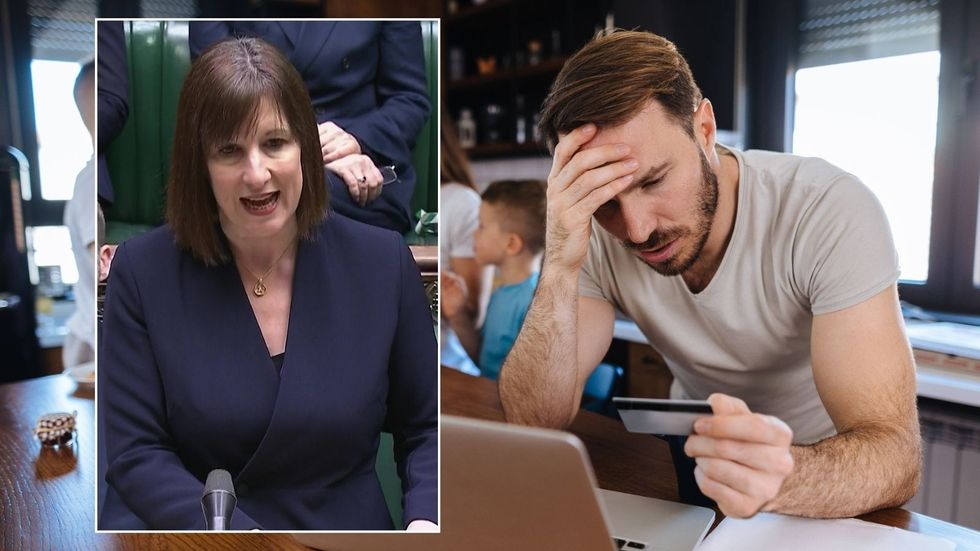

Reeves announced a £25bn increase in employers’ National Insurance in her maiden Budget, raising the rate to 15 per cent.

Reeves announced a £25bn increase in employers’ National Insurance in her maiden Budget, raising the rate to 15 per cent

GETTY

The measures also include cutting the wage threshold at which firms begin paying the national insurance levy.

Alongside the National Insurance changes, Reeves implemented a 6.7 per cent rise in the minimum wage, adding further costs to employers’ balance sheets.

Business leaders warn these dual policy changes will put significant pressure on companies’ finances when they take effect in April.

Jane Gratton, Deputy Director Public Policy at the British Chambers of Commerce said: “The labour market continues to be challenging for many businesses, with wage growth continuing to rise as firms compete for skilled workers.

“This is a concern as they face a significant rise in employment costs in April.

“To grow the economy, we need businesses and the workforce to thrive. Government must ease the cost-pressures on firms so they can invest in people.”

The BCC’s latest survey revealed 55 per cent of firms are planning price increases, driven primarily by labour costs.

LATEST DEVELOPMENTS:

The combined impact of higher payroll taxes and increased wage costs has sparked particular concern for sectors employing large numbers of low-paid workers.

Andrew Goodwin, chief UK economist at Oxford Economics, cautioned that the April increases in National Insurance contributions and the National Living Wage pose “major threats” to labour market resilience.

Sectors with high numbers of low-paid employees will “disproportionately feel the squeeze from these policy changes,” Goodwin warned.

Unemployment in the UK has risen to 4.4 per cent

GETTY

He said: “Given these sectors are typically also the most labour-intensive, this raises the risk of significant job losses, potentially pushing up unemployment in 2025.”

However, Rob Wood, chief UK economist at Pantheon Macroeconomics, offered a more moderate view, suggesting some business surveys had “exaggerated” the jobs downturn.

He said: “A payroll-tax hike worth less than one per cent of GDP is a much smaller shock than an emerging financial crisis.”