Angry farmers gridlocked central London yesterday after Chancellor Reeves’ introduced farm-threatening death duties in her recent budget.

Since Reeves’ announcement, debate has raged as to how many farms will be affected, with the government repeatedly doubling down on its claim the ‘vast majority of farms won’t be affected’.

The National Farming Union (NFU), the Country Land and Business Association (CLA), the Conservatives, the Liberal Democrats and thousands of farmers have refuted this, however.

Reform leader Nigel Farage, who attended the protests yesterday, has also weighed in on the debate, stating: “I think somebody in the Treasury got their sums wrong when they were advising the Chancellor, Rachel Reeves.

“You see, the Labour Government says it’s not a problem – 75 per cent of farms just won’t be affected by these new inheritance tax rules.

“And yet the National Farmers’ Union themselves say it will be at least two-thirds.”

The stats that Farage and the NFU are referring to come from none other than a government department, the Department for Environment, Food and Rural Affairs.

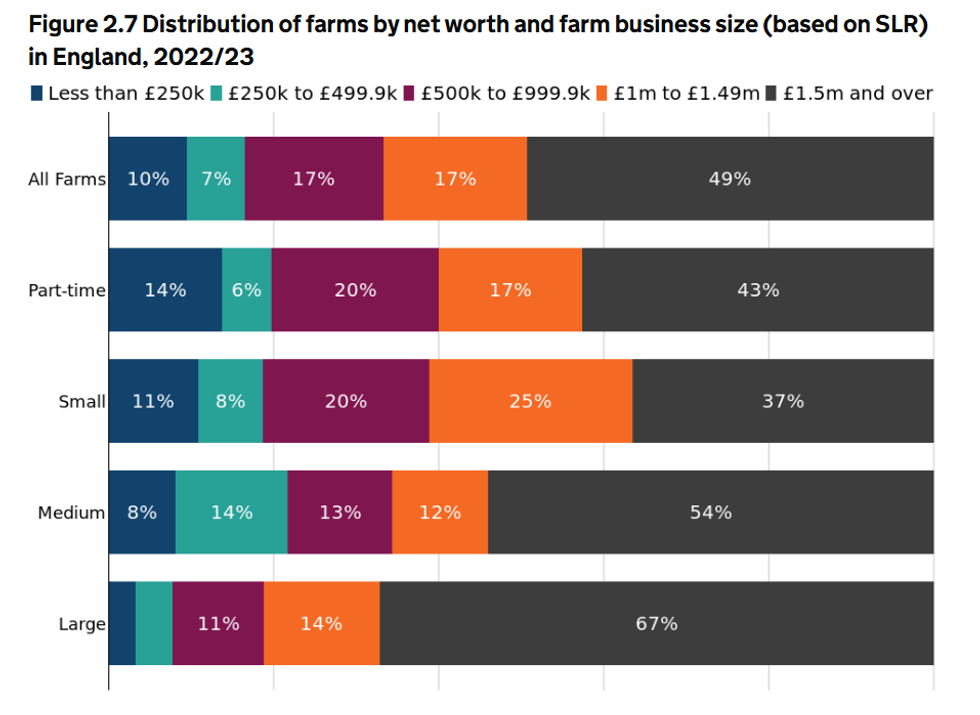

Their “balance sheet analysis and farming performance, England 2022/23” revealed 66 per cent of all farms in England were worth over £1million, the new threshold for inheritance tax, undermining the Treasury’s claim 75 per cent of farms won’t be affected.

Defra’s stats show 66% of English farms are over the new £1million inheritance tax relief cap, undermining the Treasury’s claim ’75 per cent of farms won’t be affected’

GOV.UK

The stats also revealed 49 per cent of all farms in England were worth over £1.5million, with the average value of a farm being £2.2million, well over the new threshold for death duties.

Similarly, the Treasury’s statistics from which they based their claim that only 500 of the wealthiest farms would be affected have also been severely undermined.

As the NFU and CLA pointed out, the Treasury’s analysis was based on farmers’ relief claims under the Agricultural Property Relief (APR) scheme.

They seemed to forget farmers also claim relief under the Business Property Relief (BPR) scheme for diversified aspects of their businesses.

This means the Treasury wasn’t analysing the full picture and explains how they could have underestimated the extent to which relief was used by farmers.

LATEST FROM MEMBERSHIP:

- EXPOSED: How Starmer broke MP rules on his own £400k land years before planning tax raid on farmers

- Nigel Farage pays tribute to ‘British-ness’ of protests as he stands with farmers – ‘That’s how we do it!’

- Behind the scenes with Will Hollis on the farmer battle bus as they outline OTHER ways Labour are targeting farms

Farage attending the farmers’ demo

Getty

The Treasury’s finding that 73 per cent of APR claims were below £1 million and so would be unaffected by this policy, whilst true, has also been heavily undermined by the fact many of the claims were for smallholdings worth under £500,000.

Smallholdings are not viable, food producing farms, however. £500,000 would buy you 50 acres and a house.

As the NFU said: “No viable food-producing business is 50 acres. The average farm in the UK is more than 250 acres.”

This proves how the Treasury have severely inflated the number of farms claiming under their new cap of £1million.

Nigel Farage finished: “I have to say, my conclusion on all of this is the small farmer, somebody running 5 or 10 acres, a smallholder basically will be fine.

“The giant agribusinesses, they’ll be fine as well. It’s the people in the middle that simply won’t be fine.

“…what this proposal does is hit families running farms, families whose incomes are incredibly modest, far more modest than I think most people believe.

“They’ve got an asset, yes, that’s worth a lot of money, although for many of them, it isn’t just about money, it’s about a way of life that’s been going on for generations.”

The Treasury has been approached for comment.