With Black Friday and Cyber Monday fast approaching, you’re no doubt keen to snag the best of the bargains. But, with scams coming in many different disguises and increasing volumes, Bank of Ireland is highlighting the most common scams to be on guard against ahead of one of the biggest shopping weekends of the year.

Allison Ewing, UK Fraud Customer Experience Manager, Bank of Ireland UK

PURCHASE SCAMS

These can come in the form of adverts or posts on social media or online sites ‘selling’ items or services which later transpire to be fake or non-existent. Recent data shows that purchase scams continued to be the most common form of authorised push payment scam in the first half of 2024, making up 70% of all reported cases in the UK.*

To help stay safe from purchase scams:

• Always research and read reviews to check the site and the seller are genuine.

• Never agree to buy vouchers or other items for someone as a way to pay for something else.

• Always physically view large purchases in person prior to making a small deposit payment for them, with final payment to be made upon collection.

And remember, if it sounds too good to be true, it normally is.

SMISHING

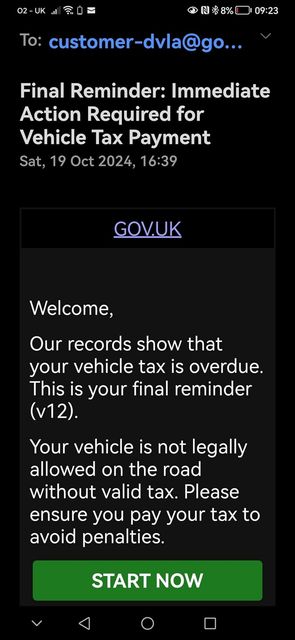

These are text messages you receive where you are encouraged to click on a link that brings you to a website where you need to input your bank or credit card details. The text often looks like it’s from a genuine company — your bank, a delivery company, utility company, phone provider or even the government. Current examples of smishing texts include those claiming to be about car parking fines or from the DVLA about overdue car tax, as well as texts claiming to offer a Winter Fuel Subsidy payment.

To avoid falling for one of these:

• Don’t click on links sent to you by email, text, or social media.

• Think, is this an unfamiliar sender address or number, or are there misspellings?

• Check the web address before opening it and never scan QR codes that you don’t trust.

FRAUDULENT PHONE CALLS

These callers claim to be from your bank or an organisation that you trust. Usually the caller makes the call and action seem urgent — needing your details to stop a fraud or suspicious payment, for example.

If this happens:

• Don’t let an unexpected caller put you under pressure — If you’re not sure who you are talking to, hang up.

• Call back using a telephone number that you can verify, for example using numbers from their official website or if they claim to be from your bank use the number on the back of your card to call them back.

• Remember — your bank will never ask for your pin or your password and will never ask you to transfer money to a safe account.

“HI MUM/HI DAD” TEXTS

This is when you receive messages, claiming to be a friend or family member, texting from a new number as they have lost or damaged their phone. Often the text or WhatsApp message will start with “Hello Mum” or “Hello Dad” and once answered, they will request money urgently to buy a new phone or pay a bill and they send you their bank details.

If you get a message like this:

• Don’t automatically accept that the message is genuine. Check by contacting them by another method, such as the phone number you already have for them, by email or through social media. Don’t send money without speaking to the person first to confirm the request is genuine.

It’s not just consumers who are the targets of financial criminals, we regularly hear from businesses about ways in which fraudsters are targeting them.

Two of the most common business scams at present are:

BUSINESS CUSTOMERS FAKE CALLS

Often these calls claim to be from your bank, with the caller advising that there is a problem, and you urgently need to go to a specific website and click on a link to “start a live chat”…

If this happens:

•Don’t click on links — it may download remote access software to your device and the fraudster then will ask you to log into your online banking — this gives them remote access to your account.

•Do not download anything you’re asked to on a call, and never ever share codes from your online banking app no matter who the caller is.

•A genuine caller from your bank will never ask for your PIN, or for any one-time passcodes sent by text or on your online banking app.

• If anyone ever asks you to make a payment or change bank details, always check with them first using the information you already have for them.

Example of a smishing text message

BUSINESS CUSTOMERS FAKE EMAILS These are usually emails faked to look like an existing supplier which ask you to use new bank account details for their next invoice payment, or can be emails faked to look like they are from someone senior in the business, such as the CEO, asking for an urgent payment to be made.

Stay safe by:

• When a change of details request comes in, always check with the supplier using numbers already held and previously used, to verify any change of details.

• Always verify any request for an urgent or unusual payment, even if it is from a senior person.

Allison Ewing, UK Fraud Customer Experience Manager, Bank of Ireland UK, says: “Financial crime comes

in many forms — from fraudulent texts and calls, to romance and purchase scams — all aimed at taking your money. Our message to consumers: Stop, Think, Check. If it sounds too good to be true, it probably is.”

Bank of Ireland has over 200 colleagues working solely on fraud prevention, protection, and the detection of financial crime. The Bank also provides 24/7 phone access where customers who are worried about, or who have been impacted by, fraud or financial crime can speak directly to a Bank of Ireland Fraud team member, as well as a TextChecker Service, allowing customers to check directly with Bank of Ireland if a text is genuine, which the Bank will confirm within 60 seconds.

If you suspect you are a victim of fraud or financial crime you should contact your bank immediately. Bank of Ireland customers can call the Fraud Team 24/7, on Freephone 0800 121 7790.

* Data from UK Finance Half Year Fraud Report October 2024 p.21