Britons are in the firing line of a “death tax” charged at a rate of 67 per cent in the aftermath of Chancellor Rachel Reeves’s Autumn Budget, analysts claim.

As part of the new Labour’s Government’s fiscal statement in 14 years, pensions which are transferred between generations once someone passed away will be subject to inheritance tax (IHT).

This inheritance tax raid on pension pots will come into effect from 2027 with retirement funds now being taxed at the same 40 per cent rate as other assets.

IHT is a levy on the estate of someone who is passed away, including their money, possessions and property, if it is valued above the £325,000 threshold.

The Chancellor’s latest reforms to inheritance tax is estimated to generate £2.9billion by 2029. Analysts are sounding the alarm that beneficiaries of any remaining cash will have to pay income tax on the bequests.

As such, households could be slapped with a 67 per cent “death tax” on taxable pension death benefits.

How have you been impacted by the Budget? Get in touch by emailing [email protected].

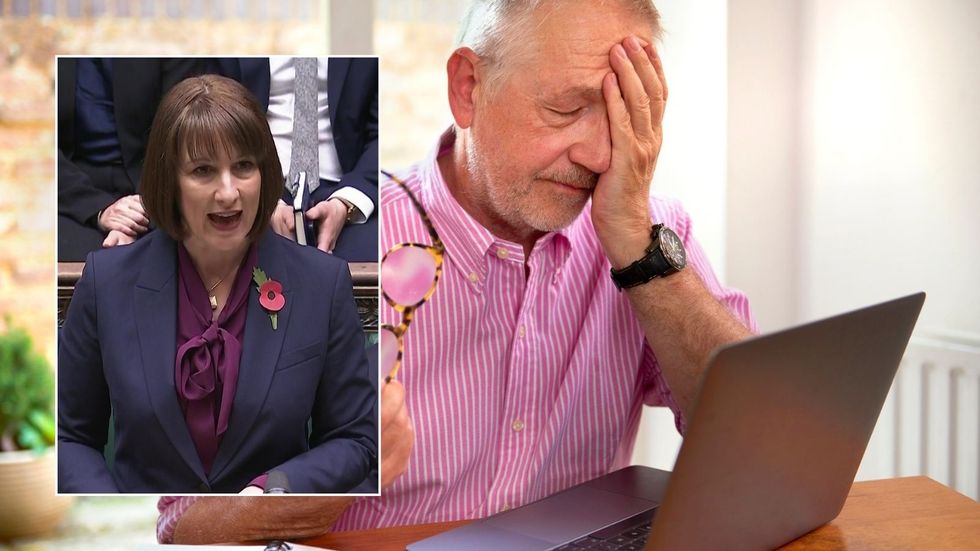

The Chancellor outlined her fiscal vision for the country during the Autumn Budget

PA/GETY

According to the Autumn Budget document, ministers cite the rule change as vital to “restoring the principle that pensions should not be a vehicle for the accumulation of capital sums for the purposes of inheritance”.

Rachel McEleney, an associate tax director at Deloitte, warned that the IHT reform is likely to result in some beneficiaries getting slapped with a “double tax” from HM Revenue and Customs (HMRC).

She explained: “The removal of the inheritance tax exemption appears to result in a double hit on death benefits that do not qualify for an income tax exemption, such as those where people die over 75 years old.

“Assuming the whole fund is subject to 40 per cent inheritance tax, and the beneficiary pays income tax at 45 per cent on the remainder, this appears to give rise to an effective 67 per cent tax rate on taxable pension death benefits.”

Despite these concerns, a Treasury source told The Times that the clampdown on inherited pensions is to ensure a fairer system.

“Tax will be paid in the same way as other savings products already subject to inheritance tax such as ISAs,” they claimed.

“Inherited pensions will be subject to inheritance tax once and, if due, income tax once. Income tax is paid on the withdrawal of the inherited pension, which reflects that income tax relief was provided when the deceased contributed to the pension.”

LATEST DEVELOPMENTS:

Households could be hit with a “double tax” following Rachel Reeve’s Budget

GETTY

Tom Selby, director of public policy at AJ Bell, noted that changes were needed to update the current “generous” treatment of pensions on death but questioned the announced reforms.

He explained: “However, by announcing plans to bring inherited pensions into the IHT [inheritance tax] net, the chancellor runs the risk of being accused of hitting beneficiaries with a new death tax.

“Anyone who made larger contributions into their defined contribution pension to make the most of the existing rules will also now be wondering what could happen to their pot when they die.”