Financial advisors are speaking out about the growing number of calls they are receiving from clients who are concerned pension tax relief could be scrapped by the new Labour Government.

Britons are preparing for Chancellor Rachel Reeves’ Autumn Budget announcement on October 30 with many suspecting reform to the retirement system will be on the agenda.

Under current rules, savers are able to withdraw their whole pension pot as cash straight away if they choose to, whatever size it is.

It is also possible for people to take smaller portions of cash whenever they need to make a withdrawal.

Notably, 25 per cent of every person’s pension pot is tax-free which means a quarter of savings can be taken without paying a charge to HM Revenue and Customs (HMRC).

Amid speculation of what will be included in the Budget, advisors are noting an uptake in the number of people requesting to make a withdrawal ahead of the tax relief being cut.

Do you have a money story you’d like to share? Get in touch by emailing [email protected].

Britons are worried about losing their tax-free pension withdrawals

GETTY

Speaking to Newspage, IFAs broke down the decision many Brits are taking to avoid being losing money to the tax man.

Mark Scott, the director of Positive Advisers, shared: “I’ve been getting many calls from clients wanting the 25 per cent tax-free cash from their pension.

“They are terrified that Rachel Reeves will start taxing this feature of the current pension system. If she does make changes, they will most likely start at the beginning of the next tax year.

“IFAs would be inundated with calls for help if this change is enacted, and the markets could see massive withdrawals, sparking a fall in values in the sell-off.”

Colin Low, the managing director at financial advice firm, Kingsfleet, has also seen similar calls for customers come in.

However, he urged anyone concerned about pension tax reform to be aware that nothing has been confirmed yet by the Government.

“It’s important to state that this is only hearsay and that is no way to shape the advice given to clients on one of the biggest financial planning decisions they will make,” Low said.

“Therefore, should clients be encouraged to take their full current tax-free cash entitlement, aware that this takes away the possibility of it growing in the future, or should they hold fast and wait for the Budget on October 30, knowing that they could lose all or some of their remaining tax free cash?

LATEST DEVELOPMENTS:

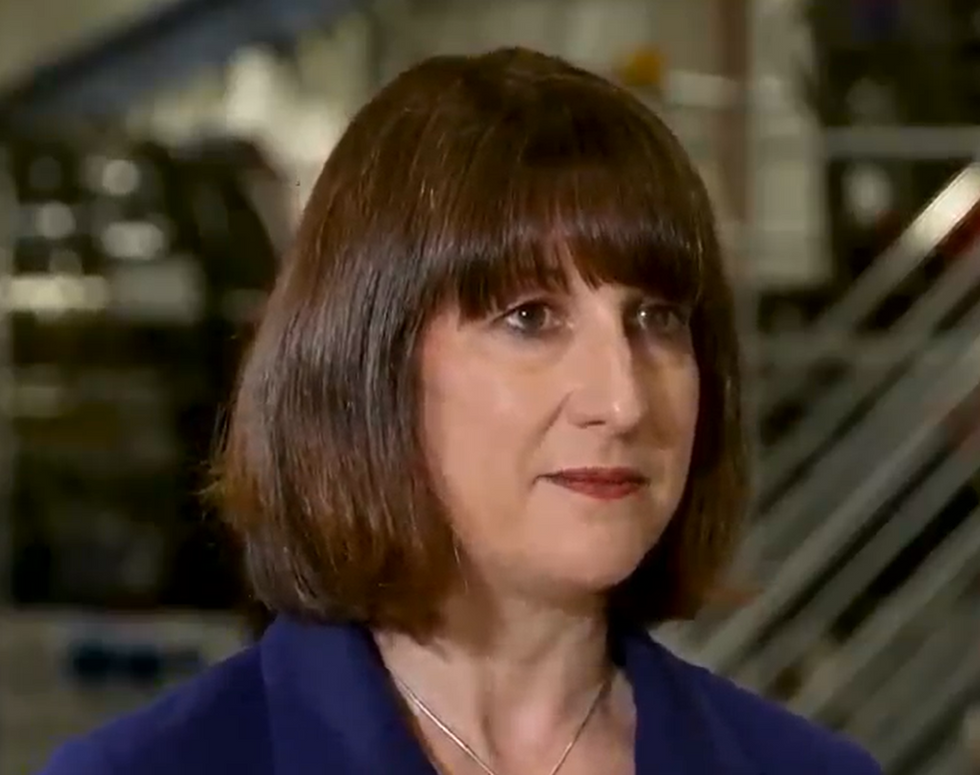

Rachel Reeves is preparing to announce the Government’s fiscal agenda

GB News

“For the Government to continue to allow these rumours to persist is really poor. We are regulated in order to encourage wise long-term decisions with money but we are caught between a rock and a hard place here.”

Ross Lacey, the director and chartered financial planner at Fairview Financial Management, cited the “transactional protection” that comes when such a change to the pension system is introduced.

This means that those who would already be affected by the new rules will keep whatever rights they currently have.

A Treasury spokesperson told GB News: “We do not comment on speculation around tax changes outside of fiscal events.”