Labour’s plans for a North Sea tax raid will ‘hurt Britain’, a top US oil and gas expert has told GB News.

Sir Keir Starmer’s manifesto pledged to rapidly build up Britain’s renewable power by increasing taxes on its oil and gas sector and vowing to end issuing new licences in the North Sea basin.

Labour said it will increase a windfall tax by 3 percentage points on energy producers first imposed in 2022.

The current 35 per cent windfall tax, which will run until 2029, brings the total tax burden on producers to 75 per cent, among the highest in the world and to 78 per cent including Labour’s planned 3 per cent rise.

The plans would also scrap an investment allowance, which exempts most profits that are re-invested in oil and gas production.

‘That’s going to hurt Britain!’ Oil expert gives verdict on Labour’s North Sea tax plan

PA/GB News

Offshore Energies UK (OEUK), which represents the sector, said investment plans over the next five years would be scrapped if the increase goes ahead, meaning the tax would provide a “short-term boost” but would then reverse British fortunes and would leave British taxpayers £12billion worse off.

David Whitehouse, OEUK’s chief executive, said: “This is a Government that has made economic growth its main priority and yet our analysis shows that its policy will ultimately reduce this sector’s contribution to the UK economy.”

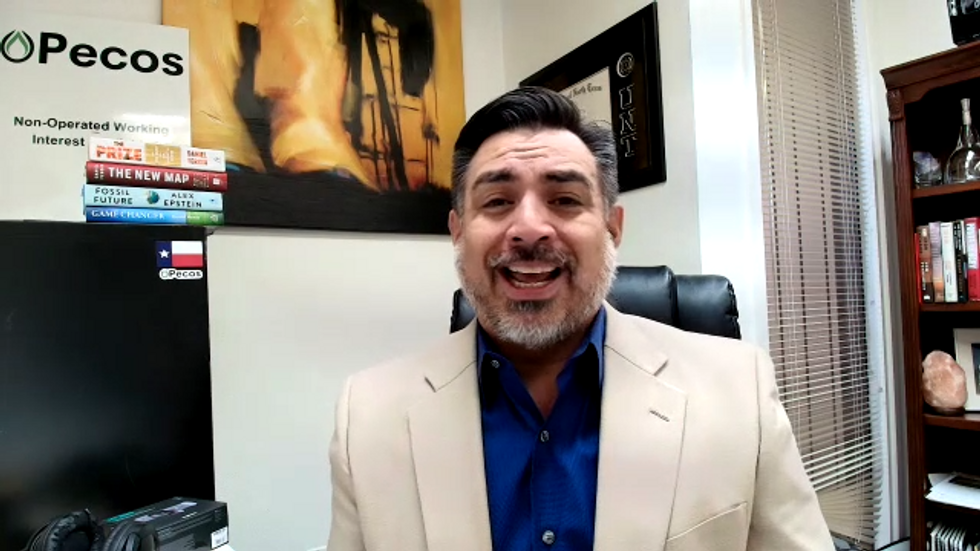

Sitting down for an exclusive interview with GB News, Rey Trevino, Vice President of the privately owned oil and gas exploration and production company Pecos Country Operating, gave his thoughts on the 78 per cent tax.

“That’s going to hurt Great Britain very much,” Trevino said.

US LATEST:

Rey Trevino told GB News the plans are more ‘anti-business’ than ‘anti-oil’

GB News

“Seventy-eight per cent tax means that for every dollar you’re earning, you’re going to give $0.78 away.

“No company is going to want to do business in a place where this is going to happen.

“So that’s more of an anti-business thing, even more than it is anti-oil.”

He added: “We need to find better and cleaner ways to produce oil and also natural gas, which y’all have a ton of there in the European area, that is really a great true transition fuel for the next 100 years until we find that next giant fuel source.

“But y’all really do have a great amount of natural gas. And since natural gas prices are so low, that’s another reason why nobody is going to want to produce and give up 78 per cent.”

Jackup rigs, used in the North Sea oil and gas industry at the Port of Dundee in the Firth of Tay

PA

The OEUK analysis forecasts that capital investments in the sector would fall by £14.1billion to land at just £2.3billion between 2025 and 2029.

In response to criticism from the OEUK, a Treasury spokesman said: “We are committed to maintaining a constructive dialogue with the oil and gas sector to finalise changes to strengthen the windfall tax.”

The host of the Crude Truth podcast continued by drawing a comparison between the US and UK and claimed it was easier for Britain to do without oil and gas.

He said: “I had a great opportunity to go to London this past summer and you guys are definitely more well-equipped for fewer gasoline and oil products from a vehicle standpoint.

“I met individuals who ride 20 miles a day each way on a bicycle, and it’s nothing to them. I think that’s great but here in America, that’s not going to happen.

“And the reason why I want to draw that comparison is because you guys are just, again, well equipped for less demand on your gasoline.

“I think we’re built differently.”