Shortly after winning the general election in July, Chancellor Rachel Reeves announced a “£22 billion black hole” in public finances left by the previous government.

To fill this hole, the Chancellor said the Government would have to “increase taxes in the Budget”.

During the general election campaign, Labour insisted that there would be no tax on the “working people”, but the Conservatives insisted Labour would increase them.

During a News Agents podcast, Reeves said she would not raise VAT, national insurance or income tax, but she did not rule out a range of other possibilities like increasing inheritance tax, capital gains tax, or reforming tax relief on pensions.

Chancellor Rachel Reeves will deliver Labour’s first Budget on Wednesday 30 OctoberPA

Chancellor Rachel Reeves will deliver Labour’s first Budget on Wednesday 30 OctoberPA

While Stamp taxes and bank taxes are probably too high to be raised, custom duties are also complicated by trade treaties.

Raising insurance premium tax without raising VAT would also be distortive and raising alcohol duty would be unpopular and out of proportion to significance.

According to Tax Policy Associates, in total, there are eleven ways the Government could raise the £22 billion through new taxes, or increases in existing taxes.

Pension tax relief – £3-15bn

Currently, if you’re a high earner, you get 45 per cent tax relief on your pension contributions. By limiting the relief to 30 per cent of even the 20 per cent basic rate, this would raise £3 billion (if limited to 30 per cent) or up to £15 billion (if limited to 20 per cent).

Limiting inheritance tax reliefs – £3bn

Reeves could launch a £2 billion inheritance tax raid on family homes. The left-leaning think tank The Resolution Foundation has already suggested abolishing the £175,000 residence nil-rate band. The think tank said there was “good cause” for scrapping the allowance which allows homeowners to shield an extra £175,000 of wealth from inheritance tax.

Pensions inheritance tax reform – £1bn

At the moment if you inherit the pension of someone who died before the age of 75, it is completely tax-free. But if they died over the age of 75 the pension provider deducts PAYE, which means up to 45 per cent tax of the beneficiary takes a lump sum. Applying the usual 40 per cent inheritance tax rule could raise about £1bn.

Increase capital gains tax – £1 – 2bn

There is a potential to raise some tax from capital gains tax, but it would need to be a modest increase, raising no more than around £2 billion. Any larger increase would make the UK look like an outlier and would realistically have to be accompanied by a return of relief for inflationary gains, which would wipeout more of the revenue.

Eliminate the stamp duty “loophole” for enveloped commercial property – £1bn+

Instead of stamp duty land tax at 5 per cent, the buyer could pay stamp duty reserve tax at 0.5 per cent of the equity value or if an offshore company is used, no stamp duty at all. After applying 5 per cent SDLT to these transactions, it could raise over £1 billion.

Increase ATED – £200m+

The “annual tax on enveloped dwellings” was introduced to deter people from holding residential property in single purpose companies to avoid stamp duty. It’s currently failing as it’s been set too low, and raises a small £111 million, which the government could triple.

Increase inheritance tax on trusts – £500m

When settling property on a trust, the trust is subject to a six per cent tax every ten years, and another six per cent when property leaves the trust. If this was raised to nine per cent, it could raise somewhere north of £500 million.

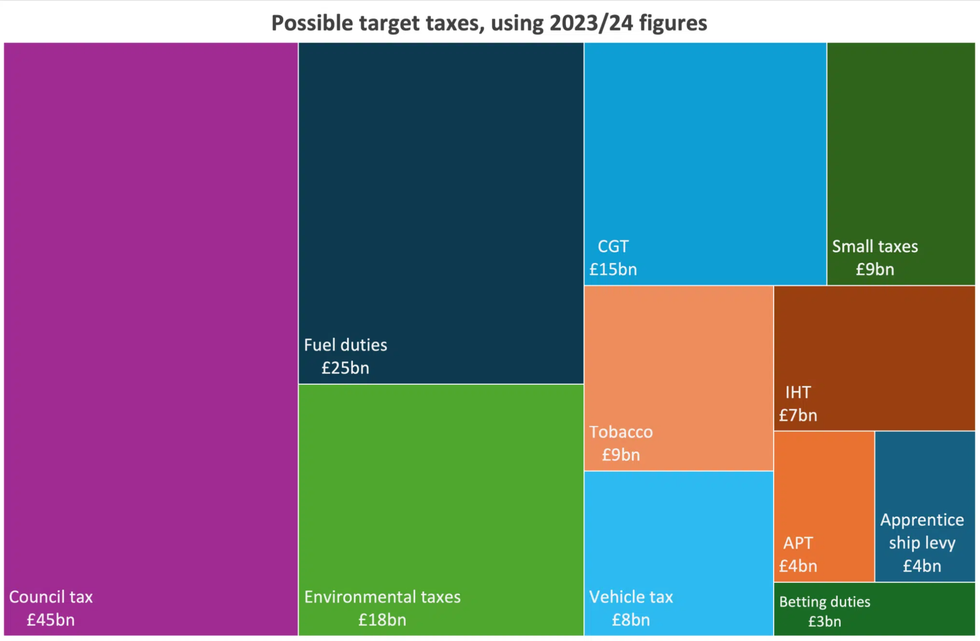

Possible target taxes the Government could use to fill the “£22 billion black hole” in public finances

Tax Policy Associates

Reverse the Tories’ cancellation of the fuel duty raise – £3bn

The Conservative Government did not raise rises in fuel duty in March, forgoing £3 billion of revenue. The Labour Government could reverse this, however, it would impact people on median and lower incomes.

Abolish business asset disposal relief – £1.5bn

This capital gains relief is supposedly for the benefit of entrepreneurs, but the benefit for genuine entrepreneurs is limited (a 10 per cent rather than a 20 per cent rate.) Abolition would raise £1.5 billion.

Council tax increases for valuable property – £1-5bn

Labour could “uncap” council tax so that it bears more relation to the value of the property. This could be done by adding more bands or applying a 0.5 per cent to all property values over £2 million. This could potentially raise £1 billion.

Increase vehicle excise duty – £200m+

Vehicle exercise duty currently applies at various rates for different vehicles depending on type of vehicle, registration date and engine size. The average car is about £200, but a £5 increase would raise £200 million. However, this again would impact people on median/lower incomes.

To fill the black hole in the public finances, applying all of these tax increases could generate £22 billion, however, the Government will officially reveal how they intend to do this in the upcoming October budget.