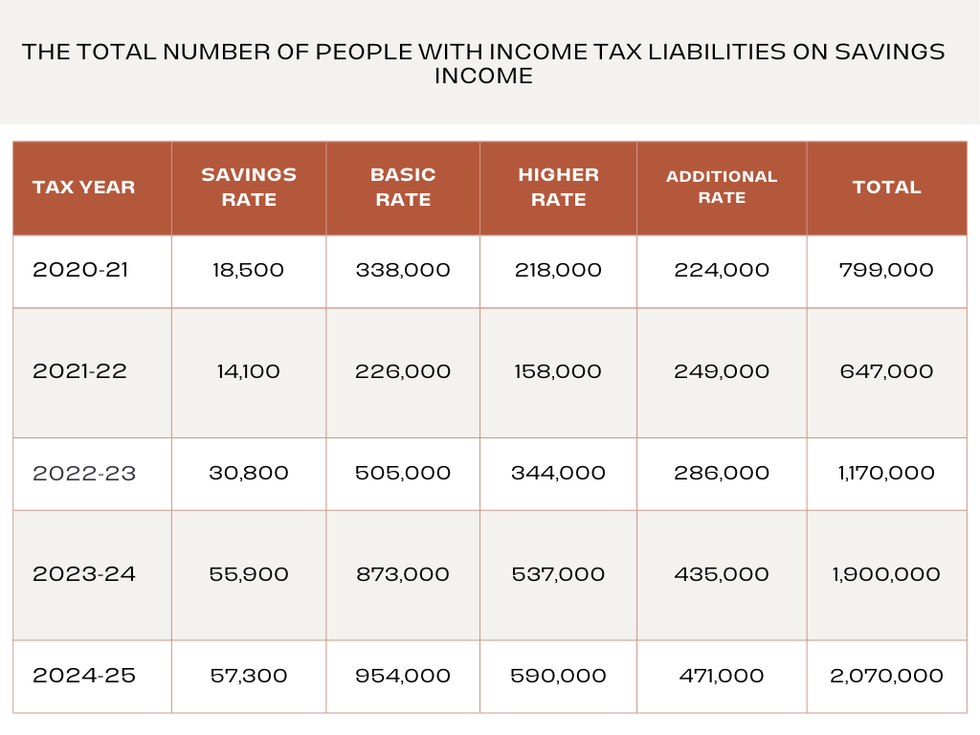

The number of people paying tax on their savings will almost double over two years, official figures show.

Government figures show that almost 2.1 million people are expected to pay tax on their savings this year, which is up from around 650,000 three years ago.

The number of basic-rate taxpayers being hit with tax will be near one million (954,000), up from just half a million in the 2022/23 tax year.

For higher and additional rate taxpayers, the combined total will rise from 630,000 to 1,061,000 over the 2024/25 tax year.

Some 2.07 million people expected to pay tax on their savings this year

HMRC

The Personal Savings Allowances protect people from paying tax on their savings interest, letting basic rate taxpayers earn up to £1,000 in interest on their savings tax-free.

Higher-rate taxpayers can earn £500 while additional rate taxpayers do not receive an allowance.

However, frozen income tax thresholds and high interest rates mean the number of savers exceeding their allowance has risen sharply over the past three years.

A Freedom of Information request from broker AJ Bell found HMRC estimates show that the number of higher rate taxpayers paying levies on their savings is expected to triple from 158,000 to 590,000 between 2021/22 and 2024/25.

It means almost one in 10 higher taxpayers are expected to pay savings tax this year, compared to around one in 25 three years ago.

The Conservatives froze income tax thresholds in 2020/21 until 2027/28 as part of a stealth raid on earnings, and nothing has been said by Labour about changing it.

This has led to millions of people being dragged into higher tax brackets as inflation pushes up incomes.

The amount savers can earn in interest before being taxed has also not changed since 2016, meaning the real values of the allowances have been eroded by inflation.

Despite this, the figures are lower than the initial amount forecast by the Government as a Freedom of Information request last year showed the Government projected 2.7 million people would be hit with tax on their savings in the 2023/24 tax year, which is now down to 1.9 million.

A number of factors could contribute to this including more savers using cash ISAs to protect their savings from tax.

Bank of England data shows that April was a record-breaking month for cash ISAs, with £11.7 billion being put into accounts, marking the highest amount since ISAs were introduced in 1999.

Another reason for the drop in figures could be that many people leave their savings sitting in old savings accounts earning very little or no interest.

Data from the Bank of England shows that £252 billion of money is sitting in accounts earning no interest

PA

LATEST FROM MEMBERSHIP:

- How Nigel Farage beat Keir Starmer in the general election and is winning the popularity contest

- ‘Brexit taught me how fascists were created’ Labour minister says at Conference fringe event

- ‘Sadiq Khan is showing his ideological hostility to driving – his latest plan will harm economy and worsen congestion’

Data from the Bank of England shows that £252 billion of money is sitting in accounts earning no interest, and many more accounts have below-average rates.

Although this means people are less likely to hit their tax-free limit for savings income, it means that people aren’t maximizing their returns on cash.

Laura Suter, of AJ Bell said: “Previously the majority of people didn’t need to worry about paying tax on their savings, as interest rates were low and the Personal Savings Allowance was sufficient to cover most people.

“But now a tricky combination of interest rates rising, cash ISAs being shunned for decades, more people moving into higher tax brackets and seeing their Personal Savings Allowance cut, and the tax-free allowance being frozen means lots of people are being dragged into the tax.”

The Treasury has been contacted for comment.