Homeowners could save up to £384 a year but only if the Bank of England agrees to cut interest rates tomorrow after the Monetary Policy Committee’s (MPC) meeting.

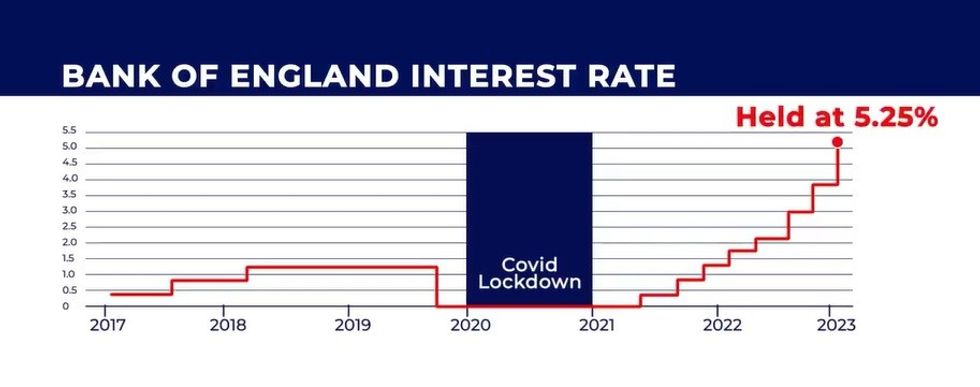

The central bank has raised, and kept, the base rate at 5.25 per cent since August 2023 which has led to mortgage and debt repayments skyrocketing for households.

This decision has been made by the Bank in its fight against inflation with the MPC citing its desired two per cent for the consumer price index (CPI) rate.

Since May, inflation eased down to this level with analysts suggesting an interest rate cut from the Bank of England is likely to be imminent.

In March 2020, the base rate was a record low of 0.1 per cent with rate settlers attempting to bolster the UK economy during the Covid-19 pandemic.

However, interest rates have increased dramatically over the last four years amid the ongoing economic fallout.

Do you have a money story you’d like to share? Get in touch by emailing [email protected].

The Bank of England has kept interest rates at 5.25 per cent PA

The Bank of England has kept interest rates at 5.25 per cent PA Most experts believe a rate cut from the Bank of England will likely not take place until later in the year.

However, if rates were to be reduced during tomorrow’s MPC meeting, many believe it would only be a 0.25 per cent cut.

This would translate to a saving of £32 per month, or £384 annually, for households on a fixed-rate mortgage.

The area most impacted by any reduction would be London with the average property price in May 2024 being £523,376.

If a 0.25 per cent rate cut, homeowners’ monthly repayments could be slashed by £59 or £708 per year.

Alastair Douglas, the CEO of TotallyMoney, said: “Having reached an all-time record low in 2020, rates rose sharply up until a year ago when they became firmly fixed at 5.25 per cent. And it looks like the base rate roller coaster might be about to restart, albeit at a much slower and cautious pace than before.

“In theory, the benefit of any rate cut should be passed on to borrowers, and homeowners without a variable rate deal should see their monthly mortgage payments drop by an average of around £32 per month.

“And while it’s not a huge amount, it will add up over the course of the year, especially if we see further cuts.”

Despite this, the mortgage expert warned that rates will likely return to pre-pandemic levels.

Douglas added: “It’s unlikely that rates will quickly return to previous low levels, and with the cost of living remaining high, hundreds of people are falling into mortgage arrears every day. If you’re struggling to keep up, then contact your lender as soon as possible.”

LATEST DEVELOPMENTS:

The Bank of England base rate has held interest rates at a 16-year high since it was hiked to 5.25 per cent last August GB NEWS

The Bank of England base rate has held interest rates at a 16-year high since it was hiked to 5.25 per cent last August GB NEWS

Andrew Hagger, Personal Finance Expert, at Moneycomms, added: “If we get a rate cut from the MPC, it will be the first since March 2020 and only the third cut in the last eight years.

“Many consumers continue to struggle to make ends meet, so a cut in interest rates will be a welcome relief to mortgage holders on a variable rate.

“For those currently on a fixed rate home loan, the financial benefit won’t be felt immediately but it should make life a little less painful when they next come to review their fixed deal.

“People will be hoping this is the first of a series of cuts in the next 6-12 months, especially as inflation appears to be back under control.”