The Labour Party committed to the state pension triple lock in their General Election manifesto, leaving millions of pensioners expecting the payment to rise by the highest out of earnings, inflation and 2.5 per cent next April.

With the Conservative Government having frozen income tax thresholds until 2028, hundreds of thousands of pensioners are edging closer to – and in some cases beyond – the tax-free personal allowance.

In this guide, we look at how the triple lock works, why it could rise in line with earnings data next year, and how pensioners could be taxed on their state pension.

What is the state pension triple lock?

The triple lock mechanism sees the state pension rise by the highest out of annual growth in total earnings, inflation, and 2.5 per cent.

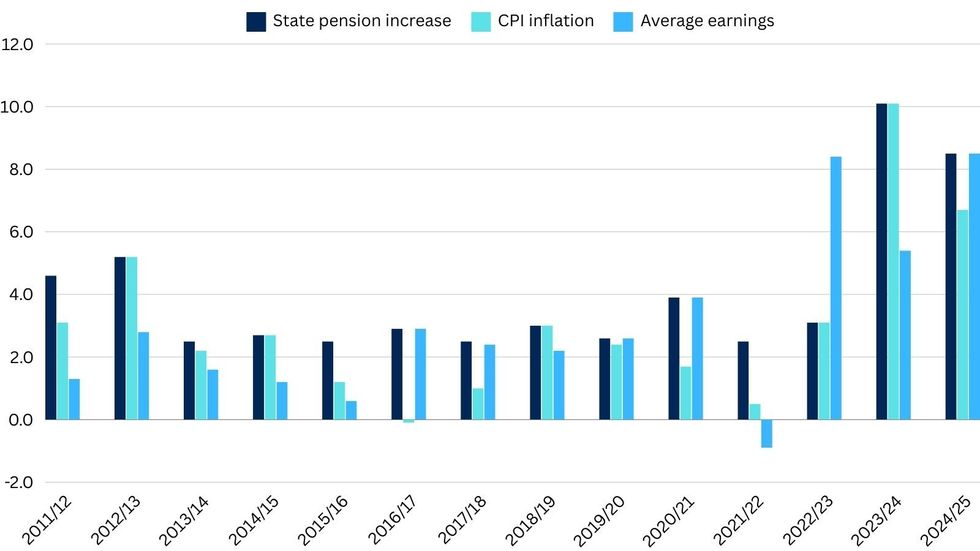

The policy, introduced in 2010, was implemented from the 2011/12 financial year.

It has only been suspended once, in 2022/23. The Government said this was due to a “distorted reflection of earnings growth” reflecting recovery from furlough and other pandemic-related measures.

House of Commons Library data shows how the state pension has increased since 2011/12

GB NEWS | House of Commons Library data

Why is earnings data likely to be key for state pension uplift in 2025?

The first two elements have not yet been published, but experts last week predicted earnings data was probably set to be the highest out of the three.

The annual growth in total earnings for May to July is used for the state pension triple lock calculations, and this data is released in September.

The inflation data for the year to September is released in October, so it won’t be until then that pensioners can see how much the state pension is expected to increase by.

However, last week, the Office for National Statistics (ONS) said the annual growth in total earnings (including bonuses) in the previous quarter – March to May – was 5.7 per cent.

Meanwhile, CPI inflation held at two per cent in the year to June.

Helen Morrissey, head of retirement analysis at Hargreaves Lansdown, said: “If wage growth is the figure used, and it remains at a similar level, we would see the full new state pension rise to more than £12,100 per year.

“Such a rise would be welcomed by pensioners who have been buffeted by the cost of living crisis.

“It may not be on the scale of increases given in the past, but it will still make a sizeable difference to people’s day-to-day spending.”

David Brooks, Head of Policy at leading independent consultancy Broadstone, said it does now “look likely” that the average earnings figure will determine the next state pension increase.

If average wages grew at 5.7 per cent in the next quarter, it would amount to an extra £655 every year for those in receipt of the full new state pension.

However, Brooks warned that earnings are not expected to remain at this level for much longer.

MORE FROM GBN MEMBERSHIP:

More and more people are facing paying tax on their state pension, after Sunak and Hunt froze the tax thresholds until 2028

GETTY

“The OBR forecasts that earnings are likely to fall sharply soon but that may come too late to avoid triggering yet another sizeable uplift to the state pension.”

While pensioners may welcome the state pension boost, more and more people are facing paying tax on their state pension, as tax thresholds remain frozen until 2028.

Millions of pensioners have been dragged into the tax net for the first time in recent years due to this freeze, Steve Webb, partner at LCP warned last year.

He highlighted hundreds of thousands of people who only get the state pension were set to face an unexpected tax bill, due to them owing tax on their state pension.

Sir Steve said: “Many are now at risk of an unexpected letter from HMRC asking for tax they may not have realised was due.

“Any pensioner with a pension next year over £242 per week will have tax to pay, and if they do not have a private pension through which the tax can be collected, they may need to set some money aside for an unwelcome tax demand.”