Barclays Bank PLC is changing how repayments are set for millions of customers.

Those with a Barclaycard could now stay in debt for many years longer and pay possibly £1,000s more in interest.

The bank is reducing the proportion of debt many of its customers have to repay as the monthly minimum.

Those only paying the minimum on their card will likely repay less each month.

Customers will now have to pay anywhere between 2.25 per cent and 4.25 per cent of their overall balance.

Before the change was introduced customer would pay the highest of 3.75 per cent of their balance, 2.5 per cent of their balance plus interest, or £5.

Minimum repayments are designed to keep customers in debt for as long as possible

GETTY

However, from today, a customer’s minimum repayments will be the highest of the following each month:

- one per cent of the customer’s main credit card balance

- one per cent of the customer’s main balance plus any interest, default fees or account fees

- the customer’s total outstanding balance, if this is less than £5.

“Shockingly, the change means that it will now typically take you a DECADE longer and cost you nearly £1,000 more than it did before to clear a £1,000 debt.”

In an email sent to customers, Barclaycard said the change “gives you more flexibility with your monthly payment”.

It added that the move is designed “to ensure customers are treated as fairly as possible”.

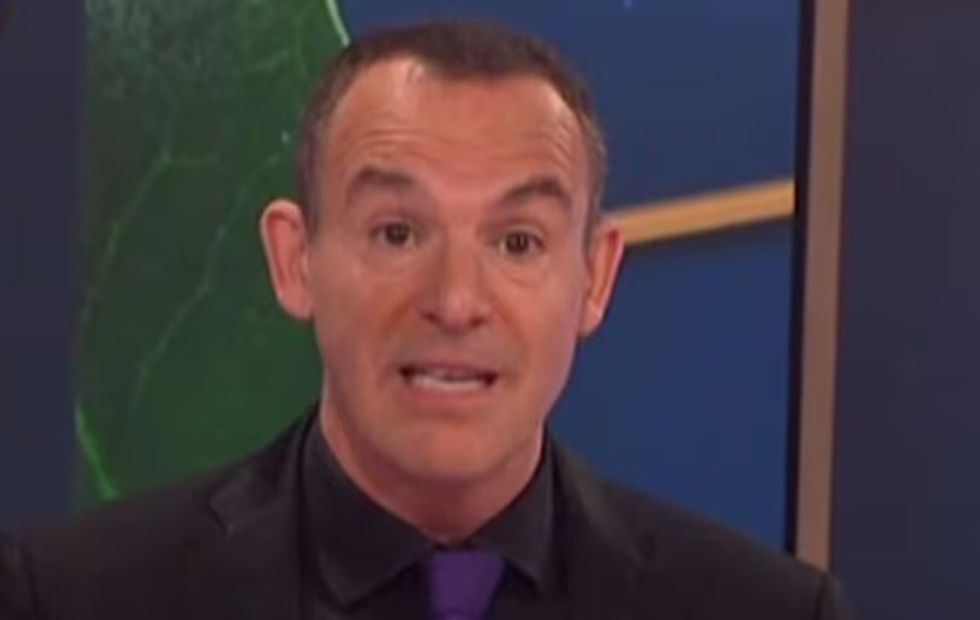

But the money-saving expert himself warned: “This under-the-radar change could DOUBLE the total cost of your debt.”

Lewis said: “Barclaycard’s reduction, for many, from 3.75 per cent of the balance to one per cent of the balance, means while people’s repayments will cover their interest, they will clear far less of what they owe, prolonging the debt, keeping people indebted year after year after year, and the interest racking up year after year after year.

“I would urge ALL Barclaycard customers to sit up, take note of this, and check now if you only pay the minimums.

“If so, unless you’ve other, even costlier debt you’re clearing first, if you can’t afford to repay in full each month, try to make a FIXED monthly repayment based on what you can afford – even if it’s the same amount as your current minimum – rather than letting your repayments decrease as you owe less.”

Martin Lewis us urging all Barclaycard customers to check now if they only pay the minimums

ITV

Barclaycard is a trading name of Barclays Bank PLC and Barclaycard International Payments Limited.