Virgin Money has recently launched a new bonus savings interest rate attached to one of its ISA accounts but customers will have to ensure they meet the bank’s eligibility criteria.

The financial institution’s additional offer is for Stocks and Shares ISA customers who opt to open a One Year Fixed Rate E-Bond Exclusive cash savings account.

Many savers choose to take advantage of ISA products due to being able to protect their money from tax with Virgin Money’s account being no exception.

Every Briton can save up to £20,000 in ISA accounts which can split between one or multiple products, however customers can only save £4,000 in a Lifetime ISA.

Through Virgin Money’s Stocks and Shares ISA, customers can choose between three different investment options.

The One Year Fixed Rate E-Bond Exclusive awards savers with an interest rate on the amount saved in the bond of 4.65 per cent AER.

Do you have a money story you’d like to share? Get in touch by emailing [email protected].

Savings interest rates are continuing to remain competitive GETTY

Savings interest rates are continuing to remain competitive GETTY On top of this, Virgin is providing bonus rate of two per cent AER so the overall rate comes to 6.65 per cent.

This is significantly higher than the current inflation rate of two per cent but customers need to have taken out Virgin Money’s Stocks & Shares ISA.

Any savers of the bank who deposit or transfer £5,000 or more to a new or existing ISA between July 1 and September 30 will access the bonus rate.

Notably, the One Year Fixed Rate E-Bond Exclusive account has to be opened between July 1 and October 7.

Jen Adams, the chief commercial officer at Virgin Money Investments, urged customers to take advantage of this deal while it is still on the market.

She explained: “Investing is one of the best ways for people to increase wealth over the long term, but cash savings are also an important way to grow money.

“By giving our investment customers up to 6.65 per cent on their cash savings, this rewarding offer provides the best of both to help our customers make the most of their money.”

In order to fully qualify for the bonus interest rate, consumers must have kept the ISA money invested until savings account matures.

If any cash is withdrawn from the ISA between July 1 and the maturity date, customers will only get the standard fixed interest rate of 4.65 per cent.

As result, the bonus interest on the account will be lost to savers.

LATEST DEVELOPMENTS:

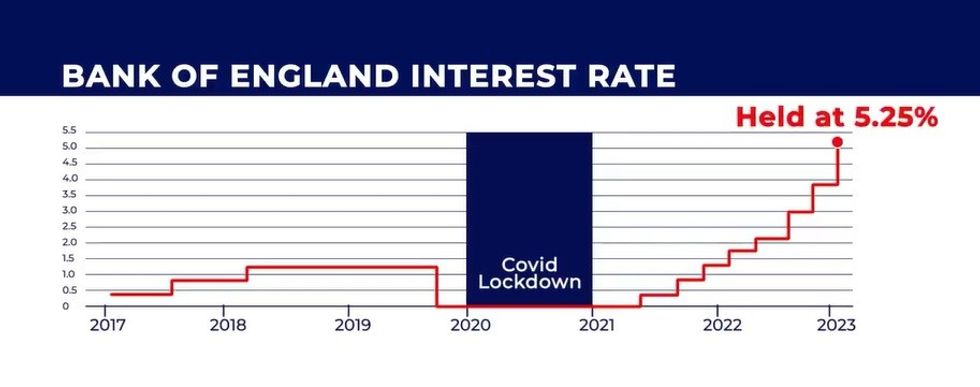

The Bank of England base rate has held interest rates at a 16-year high since it was hiked to 5.25 per cent last August GB NEWS

The Bank of England base rate has held interest rates at a 16-year high since it was hiked to 5.25 per cent last August GB NEWS

Here is full breakdown on the investment options available to customers through the Stocks & Shares ISA, according to Virgin Money:

- ‘Cautious Growth approach’ offers lower risk and slower, steadier growth potential

- ‘Balanced Growth approach’ is for customers that want to be a little more adventurous than cautious, but with a balance between risk and reward

- ‘Adventurous Growth approach’ which has higher potential and higher risk and would suit an investor who is willing to accept more ups and downs along the way