Major banks are under fire for offering customers “paltry” savings interest rates despite being put on notice by the UK’s financial services regulator.

Santander, Lloyds and HSBC are among the high street banks providing less competitive accounts compared to competitor banks, according to Which?.

The consumer watchdog’s analysis come nearly a year after the Financial Conduct Authority (FCA) issued a 14-point action plan in July 2023.

This urged banks to change their behaviour after MPs found many were not putting forward competitive rates, with the next review set to be published soon.

Which? analysed savings rates between January and June 2024 on six types of accounts, including easy access products and ISAs.

Based on this, the gulf between high street and challenger banks was most noticeable with easy access savings accounts.

Do you have a money story you’d like to share? Get in touch by emailing [email protected].

The FCA has

PA

In January, big banks were averaging 1.9 per cent on these accounts. while building societies averaged 2.9 per cent and challenger banks provided 3.3 per cent.

However, by June, the average rate for major banks plummeted to 1.6 per cent, while the rates for building societies and challenger banks remained stable.

For that month’s instant access accounts , Lloyds ranked worst of the high street banks, and third worst overall, with a rate of 1.4 per cent on their instant-access account.

In July, Lloyds was still offering the same interest with Halifax, TSB, Santander, Co-Operative Bank and HSBC providing rates of 1.5, 1.5, 1.65, 1.7, 1.81 and 1.98 per cent.

In comparison, challenger bank Cynergy Bank provided a rate of 4.94 per cent last month which is the highest instant-access rate on the market.

According to Which?’s ranking of instant access account between January 1 and June 3, Lloyds has the worse ranking of any major bank.

There have been example of competitive rates from high street banks, including Ulster Bank’s Loyalty Saver offering 5.20 per cent.

Earlier this year, Santander briefly offered a 5.2 per cent but many high-rate accounts are only available to current account holders.

Under the FCA’s plan, providers are required to explain why they are offering the lowest interest rates and justify whether they are providing fair value to customers.

The regulator has also promised to take action on those who fail to do so.

LATEST DEVELOPMENTS:

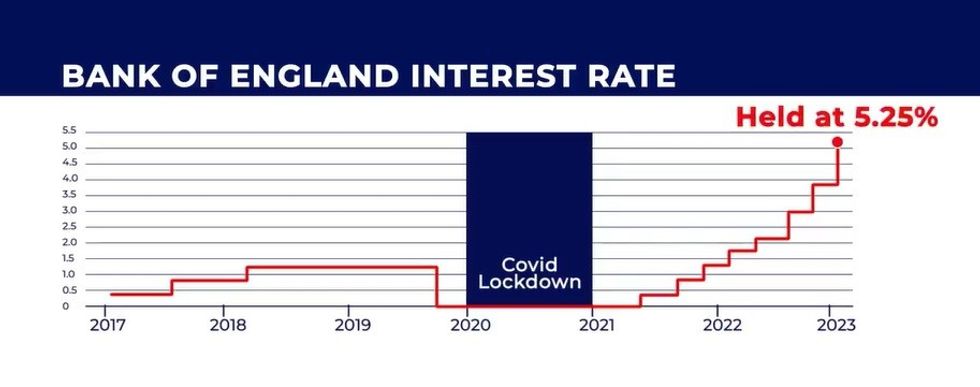

The Bank of England base rate is currently at a 15-year high of 5.25 per cent GB NEWS

The Bank of England base rate is currently at a 15-year high of 5.25 per cent GB NEWS

Sam Richardson, the deputy editor of Which? Money, called on the FCA to take against high street banks and building societies who are not doing enough

He explained: “It is completely unacceptable that big banks continue to shortchange savers despite repeated warnings from Which?, MPs and the regulator.

“As savers face the prospect of base rate cuts, banks will likely be quick to implement any reductions, yet our research shows they have dragged their heels in responding to calls for better rates.

“In its upcoming review, the regulator must take decisive action against firms that have failed to provide fair value, leaving them in no doubt that they will intervene against any future unfair practices.”

GB News has contacted Lloyds Bank, Santander and HSBC for comment.