Banks and building societies have been pushed to improve their treatment of politicians in the wake of last year’s debanking scandal involving Nigel Farage and NatWest.

A lengthy review by the Financial Conduct Authority (FCA) found most firms did not subject so-called politically exposed persons (PEPs) to overly excessive checks or deny them an account based on their status.

However, banks, payment firms and lenders have been told to improve the way MPs, political figures and their families are treated in the provision of banking services.

The financial services watchdog outlined the various ways banks will be able to do this going forward in order to avoid similar scandals from taking place.

In June 2023, NatWest-owned private bank Coutts closed an account held by Reform MP Nigel Farage.

The bank initially claimed this decision was made due to the GB News presenter failing to meet Coutts’ eligibility criteria of having £1million ore more in his account.

Do you have a money story you’d like to share? Get in touch by emailing [email protected].

NatWest says there’s no evidence of discrimination in Coutts bank account closures GETTY

NatWest says there’s no evidence of discrimination in Coutts bank account closures GETTYHowever, it was later discovered the private bank closed Farage’s account due views that were deemed “at best seen as xenophobic and pandering to racists”.

The controversy surrounding the Reform leader’s debanking resulted in the resignation of NatWest’s then-CEO Dame Alison Rose.

Some firms have already begun to make improvements after FCA findings in January 2024. This was when the legal starting point was determined that UK PEPs and their associates present a lower level of risk than foreign PEPs.

Notably, the regulator cited that it is instigating an independent and more detailed review of firms’ practices in a small number of cases.

Here is a full list of the improvements the FCA is recommending being made:

- ensure their definition of a PEP, family member or close associate is tightened to the minimum required by law and not go beyond that

- review the status of PEPs and their associates promptly once they leave public office

- communicate to PEPs effectively and in line with the Consumer Duty, explaining the reasons for their actions where possible

- effectively consider the actual level of risk posed by the customer, and ensure that information requests are proportionate to those risks

- improve the training offered to staff who deal with PEPs

Sarah Pritchard, the FCA’s executive director of markets and international, commented:

She explained: “Public service naturally comes with greater scrutiny. But it must be proportionate and shouldn’t disadvantage people running for office or taking senior public roles, or their families.

LATEST DEVELOPMENTS:

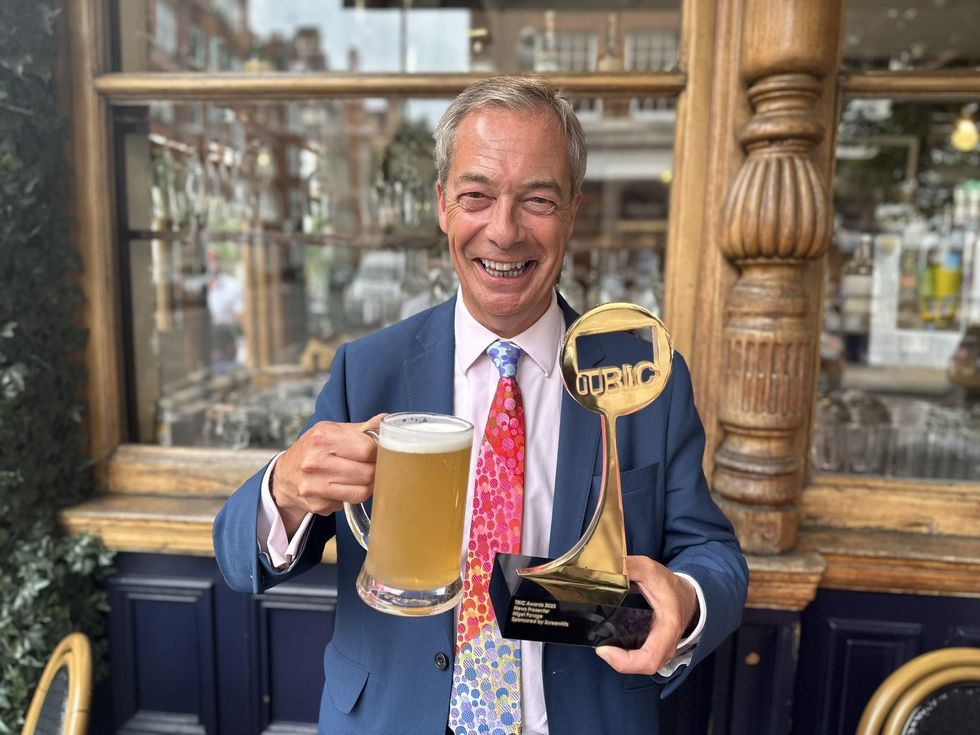

Farage has taken big banks to task over potential debanking scandal

Twitter/Nigel Farage

“That requires a balancing act. Most firms try to get it right but there is more they can do.

“We’re following up with those firms that were getting the balance wrong to ensure they make changes.

“We have heard directly from some parliamentarians about the problems they and their families have faced.

“We have been clear where we expect firms to make improvements, including in how they communicate with their customers.”